Central Pennsylvania is in the midst of a new construction boom when it comes to industrial real estate. Last quarter, eight new buildings were delivered to the market and this quarter, we see another five new properties reach completion. Additionally, five more buildings are under construction and set to be delivered later this year. Combined, this is millions of square-feet of space, with much of it not yet occupied or preleased.

How is this new construction trend impacting the local market? Moreover, what can it tell us about the health of the local economy? Here is summary of the data from first quarter 2016 for the Central Pennsylvania industrial submarket that provides insight to help answer these questions.

Select Year-to-Date Deliveries:

Five of the top nine Select-Year-to-Date Deliveries for first quarter 2016 are located within the Central Pennsylvania submarket. Coming in at number two on the list is 575 Old Forge Road. This property has an RBA of 500,000 square-feet and is 0% occupied. Number four on the list is the Susquehanna Logistics Center with an RBA of 4323,300 square-feet and is also 0% occupied. The third of the five Select-Year-to-Date Deliveries in Central Pennsylvania comes in at number seven on the list. It is located at 1165 Strickler Road with an RBA of 40,000 square-feet and is 100% occupied. Next, at number eight on the list, is 551 Manchester Court with an RBA of 36,000 square-feet and is 100% occupied. Finally, at number nine is 211 Piper Circle with an RBA of 26,825 square-feet and 45% occupied.

Select Top Under Construction Properties:

The incredible amount of new space being pumped into the Central Pennsylvania industrial real estate market is only going to continue to increase as five more properties are under construction and expected to be delivered in 2016. These properties include: Lebanon Valley Distribution Center with an RBA of 874,126 square-feet; Eden Road Logistics Center with an RBA of 755,421 square-feet; Trade Center 44 with an RBA of 620,000 square-feet; 192 Kost Road with an RBA of 422,400 square-feet; and LogistiCenter 78-81 with an RBA of 405,000 square-feet. All five properties are 0% preleased.

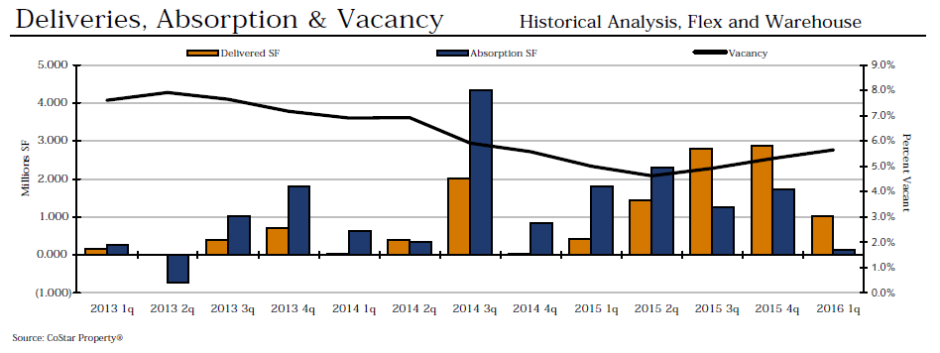

Absorption and Demand:

Net absorption has dropped significantly since last quarter. Previously at 1,730,592 square-feet in fourth quarter 2015, it ended first quarter 2016 at 123,946 square-feet. Contributing to this trend is the delivered inventory of five buildings this quarter and eight buildings last quarter with a combined impact of 3,904,745 square-feet of new space in six short months!

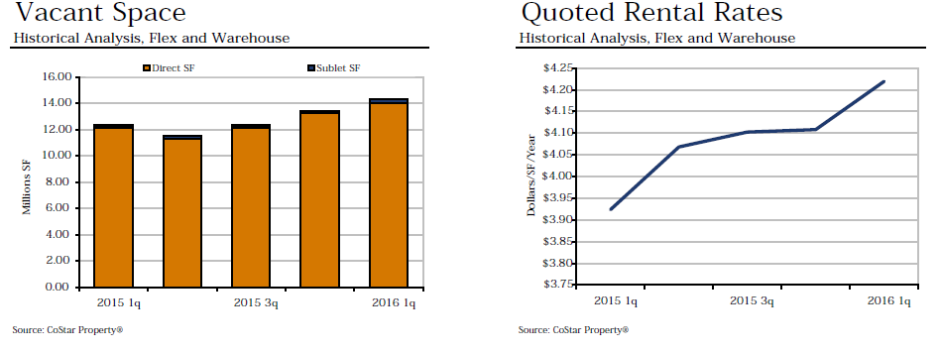

Vacancy:

This quarter, the vacant square footage jumped from 13,451,560 to 14,353,739. The vacancy % jumped from 5.3% to 5.6%, which is the highest we have seen it since fourth quarter 2014. Compared to the vacancy % that was in the 6’s and 7’s prior to second quarter 2014, this is still moderate to low, but it is showing a trend of increasing over the last year.

Rental Rates:

The quoted rental rates have increased by $0.11, from $4.11 last quarter to $4.22 this quarter. This is the highest quoted rental rate the Central Pennsylvania industrial submarket has seen since prior to second quarter 2012.

Our Summary/Analysis:

Although net absorption dropped significantly and large amounts of space continues to be added to the market, I believe that the demand for space will continue to soar. The whole chain of moving goods, from producer to consumer, is being upended by consumer shifts toward e-commerce, to the advantage of wholesalers and warehouse space, generally. Other demand drivers are also firing strongly, in concert with the continuing economic recovery. As with other property sectors, demand for space naturally rises with GDP growth and especially job growth.

But industrial demand depends on two factors, in addition to retail demand: trade and housing construction. Warehouses benefit from housing construction as home builders need large spaces in which to store their materials. Housing stats are not at the level of the mid 2000’s. But volumes have recovered nicely since the recession, with the annual rate now up to 1.1 million units, twice the rate at the depth of the recession and finally approaching the levels of the mid 1900’s prior to the housing boom.

And trade is up, building on a long upward trend for both imports and exports dating back at least 50 years due to greater trade liberalization. Exports and imports combined have tripled their share of our nation’s Gross Domestic Product, from less than 10% in the 1960’s to almost 30% now. Our growing trade means that an increasing share of products that we buy and sell, end up in warehouses at some point in their journey from producer to consumer. Putting all these factors together – rising trade, increasing housing construction, and the shift to e-commerce, all in the context of at least moderate economic growth – provide fuel for strong tenant demand for warehouse space.

How do you anticipate the boom in new industrial real estate space will impact the local market and economy? Share your insights by commenting below!