The Cost of Commercial Real Estate in Central PA Rises Across All Sectors: Office, Retail and Industrial

2016 wrapped up with quite an interesting quarter for Central PA’s commercial real estate market. Out of all the sectors, office space was the weakest performer. However, even though it dropped to a negative net absorption, its rental rate continued to rise. Retail and Industrial space were the stronger performers. Both finished out the quarter with the highest sales price per square foot that the market has seen for at least four years. In all sectors, new space is rapidly being delivered to the market, which should make it interesting to see how this impacts absorption in future quarters. Take a look at the breakdown of each sector of commercial real estate in Central PA and how it performed in Q4 2016, according to CoStar.

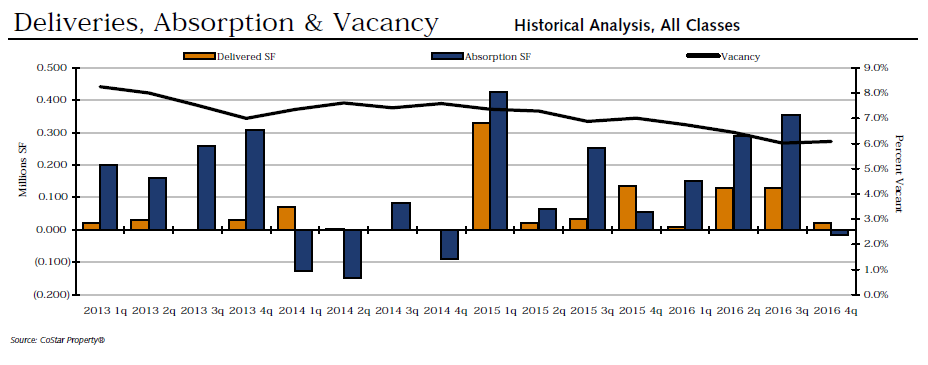

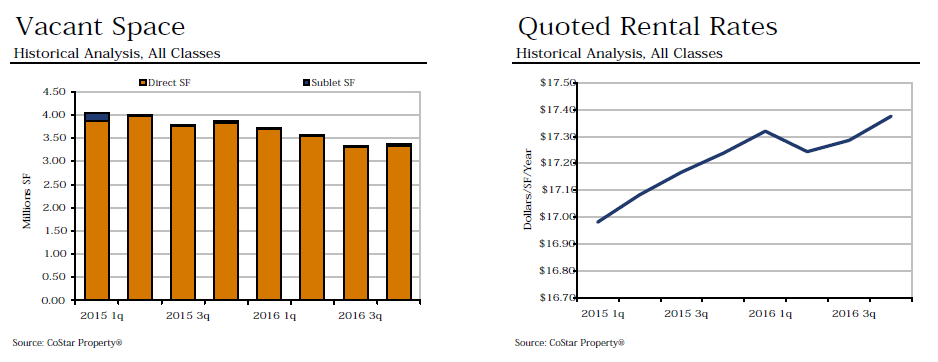

OFFICE

In Q4 2016, Central PA’s office real estate market saw an increase in vacancy, rising to 6.1%. It also dipped into a negative net absorption of -14,026 square feet. Only one building, located at 300 Winding Creek Boulevard in Mechanicsburg (20,000 sqft), was delivered this quarter while four more remain under construction. Once they deliver, they will add a combined 133,590 square feet of new space to the market. Interestingly, the quoted rental rate rose this quarter to $17.38 per square foot, an increase of $0.09 from last quarter and an overall record high from prior to 2013.

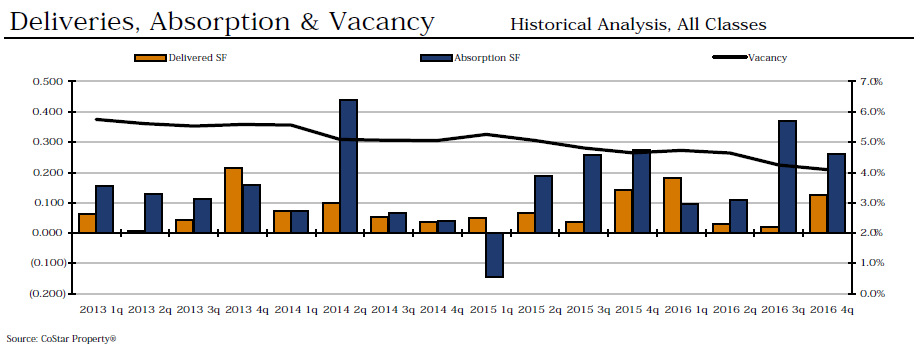

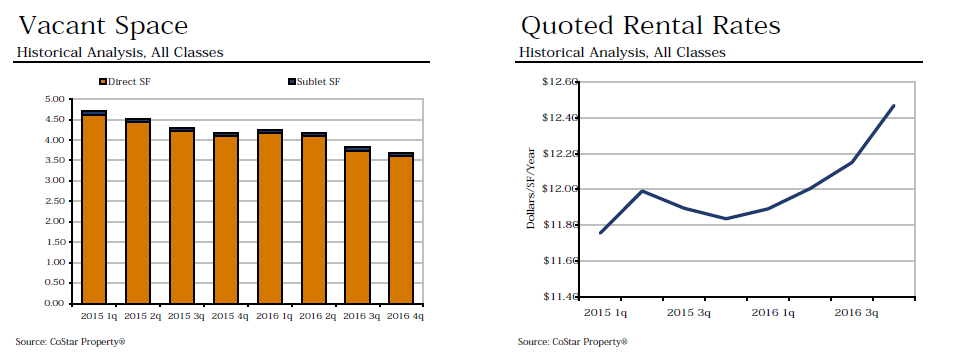

RETAIL

In Central PA’s retail real estate market this quarter, a total of 12 new buildings were delivered. Combined, these added 126,296 square feet of new space to the market. Additionally, 12 buildings remain under construction, but once completed will add a combined 272,338 square feet of additional retail space. All of this added space barely impacted vacancy, and in fact, moved the needle in the opposite direction than what might be expected. The percentage of vacant space available dropped down by 0.1% to 4.1%. This is the lowest vacancy has been since prior to 2013. The quoted rental rate jumped up $0.32 to a total of $12.47 per square foot. This is the highest price we have seen also since prior to 2013. Though net absorption decreased by 108,583 square feet, it remains in the black at 262,060 square feet.

Two properties in Central PA made it to CoStar’s list of Select Year-to-Date Deliveries. They are located at I8-1 and Walker Road (109,239 sqft) and 700 West Main Street, Annville (33,000 sqft). Among the 15 Select Top Under Construction Properties featured by CoStar, only one from Central PA made the list and this is the project located at 101 Wilson Avenue in Hanover (136,193 sqft).

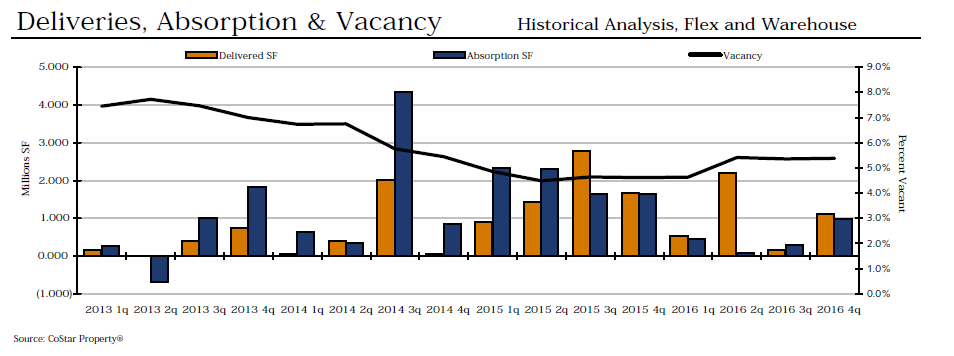

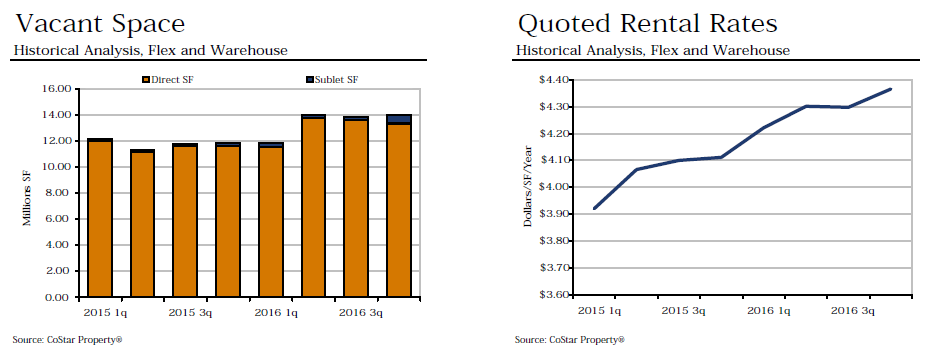

INDUSTRIAL

Central Pennsylvania’s industrial market gained four new buildings this quarter with a combined RBA of 1,114,800 square feet. Another 14 buildings still remain under construction and are projected to deliver 6,630,117 square feet of space, once complete. Despite the influx of new space, vacancy has not budged from last quarter and remains at 5.4%. The quoted rental rate even increased by $0.07 from last quarter to $4.37 per space foot. This is the highest rental rate we have seen since prior to 2013. Although net absorption did decrease, it remains in the black at 987,110 square feet.

Of the Select Year-to-Date Deliveries, Central PA made the list three times for the following buildings: Lebanon Valley Distribution Center (874,126 sqft), Trade Center 44 (620,000 sqft) and Gateway Logistics Park – Building B (500,000 sqft). Central PA also had a strong presence on the list of Select Top Sales with 3 of the top 9 properties located in Carlisle and Mechanicsburg.

What trend from Q4 2016 did you find most interesting or impact to the Central Pennsylvania Economy? Share your insights by leaving a comment below.

Learn more from past market reports:

Central Pennsylvania’s Retail Real Estate Market Experiences Record-Setting Quarter

Central PA’s Office Market Sets Recent Records for Vacancy, RBA and Rental Rates!

Influx of New Construction Impacts Central PA’s Industrial Real Estate Market