10 Facts Any Commercial Real Estate Investor Should Know about Central PA’s Industrial Market

Central PA’s industrial real estate market is unique for a variety of different reasons. Taking into consideration its geographic, demographic and economic factors, we’ve compiled a list of what we feel are the most important facts worth knowing about our local industrial market.

If you are a commercial real estate investor, or simply someone who wants to know more about Central Pennsylvania’s commercial real estate market, you are sure to find this list of top 10 facts both valuable and interesting. Let’s take a look!

- Harrisburg-York-Lebanon CSA is 3rd most populous in PA and 43rd most populous in U.S.

The Harrisburg-York-Lebanon Combined Statistical Area (CSA) is made up of six counties and includes four metropolitan areas in Central Pennsylvania. In 2010, the CSA’s population was 1,233,708 people, making it the 3rd most populous CSA in PA and the 43rd most populous CSA in the U.S. The Harrisburg-York-Lebanon CSA includes the following Metropolitan Statistical Areas (MSAs): Harrisburg-Carlisle, Lebanon, Gettysburg and York-Hanover.

- Harrisburg area puts up strong competition against Lehigh Valley.

Though Lehigh Valley is commonly recognized as Pennsylvania’s leader in warehousing and distribution, Harrisburg delivered only 600,000 SF less than Allentown in 2017, while also generating roughly the same rent growth. Additionally, companies such as Whirlpool, Amazon, Ace Hardware, FedEx, Kohler, and Lindt Chocolates have set up large-scale warehouse and distribution centers in Harrisburg – and those tenants account for just a portion of more than 16 million SF of net absorption.

- Harrisburg-Carlisle and Lancaster Ranked Among Leaders in National Job Growth

Of the 25 metro areas with the fastest job growth, as of August 2017, both Harrisburg-Carlisle and Lancaster placed on this competitive list. Lancaster ranked number 24 for its steady growth as it diversifies its economy and renovates its downtown and industrial areas. In six months Lancaster added 3,100 new jobs, bringing its total employment to 252,400 and 2017 growth rate to 1.23%. Harrisburg-Carlisle ranked number 8 on the list with 6,200 new jobs added in the first two quarters of 2017, bringing total employment to 346,100 and 2017 growth rate to 1.82%. Noted was the area’s diverse group of healthcare, technology and biotechnology businesses.

- Prime location for warehousing and distribution.

Central Pennsylvania is a premiere market for industrial space for several compelling reasons. For businesses who need easy and affordability storing and shipping of products, the areas offers a great roadway system, an abundant work force, relatively inexpensive and available raw land, and the ability to reach 70 to 80 percent of the U.S. population in 24 hours. Additionally, our government regulations on warehousing and distribution are comparatively easy and straightforward compared to other nearby states or regions.

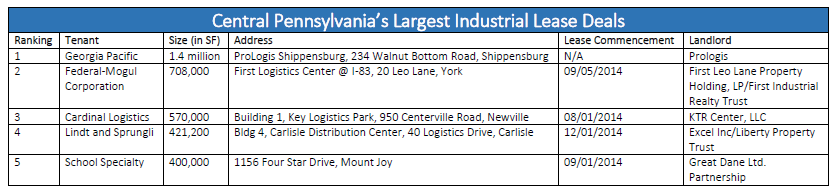

- Four of the 10 Select Top Industrial Leases in Q4 2017 took place in the Harrisburg market.

According to CoStar’s Q4 report for 2017, Harrisburg east and west markets represented the majority of top industrial leases signed that year. Prologis Carlisle (1,029,600 SF), Goodman Logistics Center Carlisle (1,007,868 SF), Prologis Harrisburg (623,143 SF) and Carlisle Distribution Center (575,000 SF) were all leased to different businesses who were looking to grow their industrial real estate space in Central Pennsylvania. This activity indicates economic growth and interest in Central PA’s industrial real estate market, both from businesses and real estate investors.

- Lancaster market has the highest quoted rental rate for industrial space in Central PA at $4.69 per SF.

Even though Lancaster’s quoted rental rate for industrial space decreased by $0.45 per SF than where it was at the end of Q4 2016, it still comes in higher than Central PA’s other surrounding submarkets. At $4.69 per SF, Lancaster is $1.41 per SF higher than Lebanon, $0.03 per SF higher than Harrisburg/Carlisle, $0.08 per SF higher than Gettysburg and $0.67 per SF higher than York/Hanover based on Q4 2017.

- Lancaster also has the lowest vacancy rate for industrial space in Central PA at just 2.0%.

Lancaster ended Q4 2017 with the lowest vacancy rate of all surrounding submarkets. Compared to Lancaster’s vacancy rate of 2.0%, Lebanon came in at 15.8%, Harrisburg/Carlisle at 6.8% and York/Hanover at 4.9% based on Q4 2017. Though Gettysburg did end 2017 with a vacancy rate of 0.4%, it’s important to note this submarket has just 78 buildings with a combined 4,372,179 SF of existing inventory which places it at a much different level than the other submarkets, comparatively.

- Within the MSA, Harrisburg/Carlisle has the largest SF of industrial space under construction at 1,813,468 SF.

Two significantly large industrial projects will soon result in the addition of 1,813,468 SF to the Harrisburg/Carlisle submarket. Comparatively, Lebanon has three buildings under construction with a combined 1,310,195 SF of space, Lancaster has two buildings under construction with a combined 76,486 SF of space, York/Hanover has two buildings under construction with a combined 895,000 SF of space and Gettysburg has no new industrial space under construction. For Central PA as a whole, that equals 4,095,149 SF of new industrial space that will soon be delivered to the market.

- Harrisburg/Carlisle’s ended 2017 with a positive net absorption of 2,700,108 SF.

According to CoStar’s Q4 2017 industrial market report, Harrisburg/Carlisle ended the year with the highest, positive net absorption we’ve seen since prior to 2014. At 2,700,180 SF, this is significantly higher than any other quarter that year, especially Q2 where the net absorption dropped to negative 499,576 SF. Additionally is Q4 2017, one new building was delivered to the market, adding 1,100,000 SF of space. Even with this influx of inventory, the net absorption rose by 2,083,756 SF. The new building that was delivered is Whirlpool’s new distribution facility located at 100 Fry Drive, Mechanicsburg.

- Influx of State and Federal dollars will continue to improve transportation in and around Central PA.

The Trump administration has recently been touting a $1.5 trillion, 10-year public-private plan to improve roads, bridges, ports and other infrastructures across the nation. Central Pennsylvania has plans to utilize some of this federal funding to bolster its priority projects which include fixing structurally deficient bridges and widening interstates. Improvement to our roadways and infrastructure will improve public safety, create construction jobs and make Central PA an even more attractive location for warehousing and distribution.

After reading through these top 10 facts any commercial real estate investor should know about Central PA’s industrial market, you are likely to have some comments or questions of your own.

Start a discussion by leaving a comment below!