As we approach the holiday season, and with holiday shopping already in full swing, it’s become a glaring truth that COVID-19 has divided retail companies into two distinct groups: those with functioning e-commerce businesses, and those without.

During the first 10 days of the holiday shopping season, U.S. consumers spent $21.7 billion online, a 21% year-over-year jump, according to Adobe Analytics. This likely stems from the fact that 63% of consumers are avoiding stores and buying more online, with health concerns due to the pandemic driving that decision for 81% of shoppers. Furthermore, U.S. consumers are poised to spend $198.73 billion with online retailers this holiday season. That would be a 43.3% year-over-year jump from $138.65 billion for the same November-December period in 2019.

What this means for businesses hoping to get in on some of these holiday shopping dollars is that they need to have an easy and efficient way for consumers to buy their products online and have them quickly delivered to their doorstep. For many businesses that don’t already have this infrastructure in place, they could sustain a huge blow this holiday season that may be too much to recover from. In contrast, businesses like Amazon and Walmart who are leading the charge in e-commerce are set to have a banner year when it comes to online holiday shopping.

Central PA Region Boasts Strong Market for Industrial Real Estate

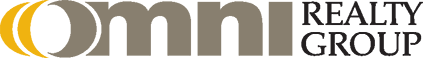

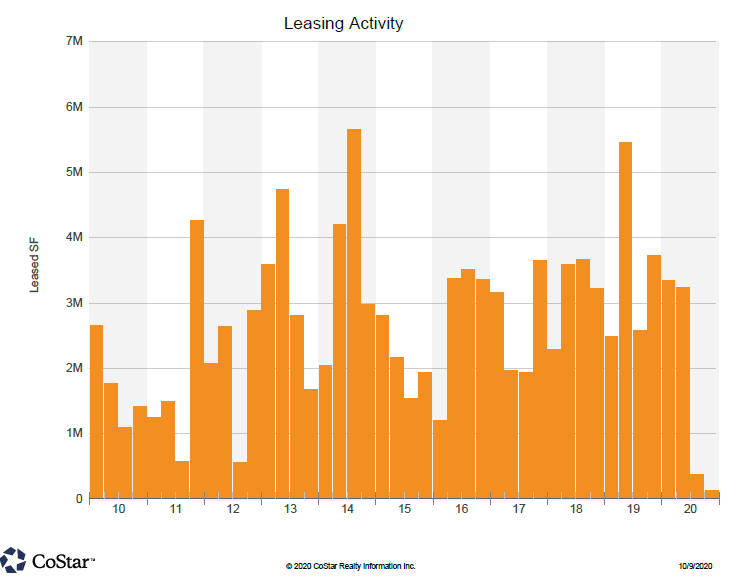

In order to support a thriving e-commerce business, it requires ample and functional industrial real estate space to store and distribute massive amounts of inventory. Right here in Central Pennsylvania, Amazon and Walmart remain the most active industrial real estate leasees for Q3 2020. And it makes sense as to why. Amazon is by far the leader of the pack with nearly 13 million square feet of industrial space in this market alone. Coming in second is Walmart with 3 million square feet, and all other players in the field far behind that. This shows just how much of an e-commerce monster Amazon really is and how well prepared they are to take full advantage of this holiday season’s online retail.

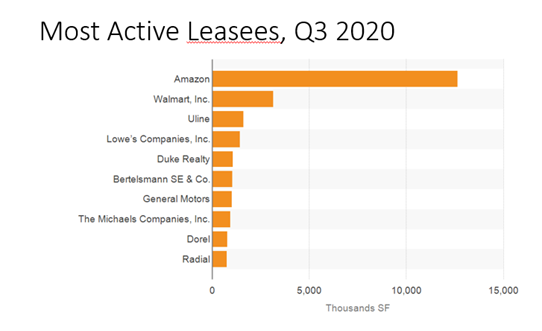

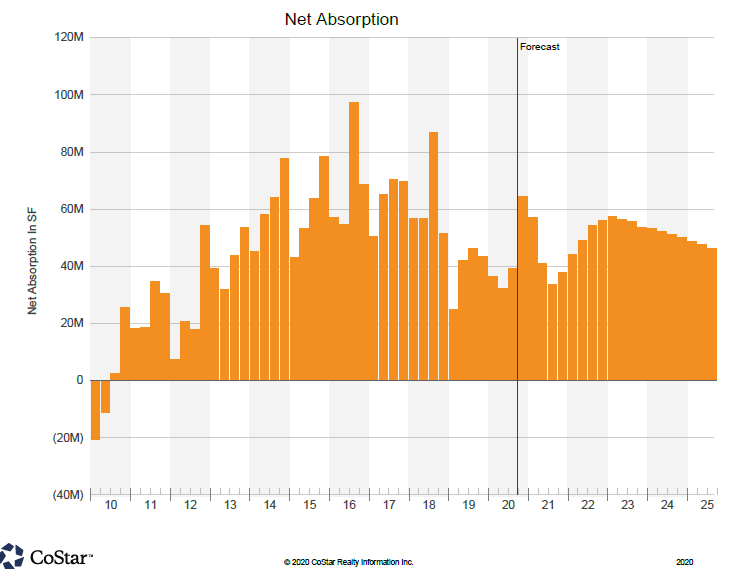

And it’s no coincidence that the leading e-commerce businesses have chosen to take stock in the Central Pennsylvania region. The I-81 corridor is widely recognized as a hot spot for industrial real estate, warehousing, and distribution. With easy access to all the major markets and highways, it’s obvious why the Lehigh Valley ranks #7 and Harrisburg ranks #18 on the national list of net absorption as share of inventory. Additionally, Lehigh Valley’s rent growth came in at 4.9% year-over-year, making it among the top 20 cities in the nation.

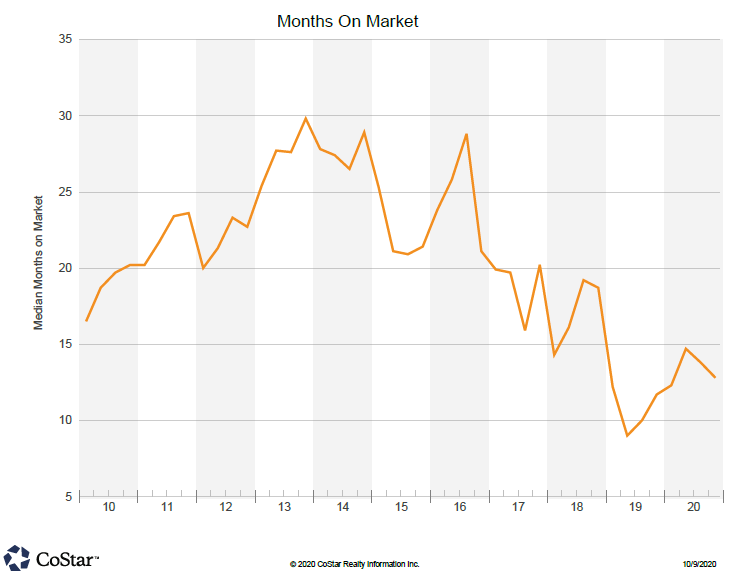

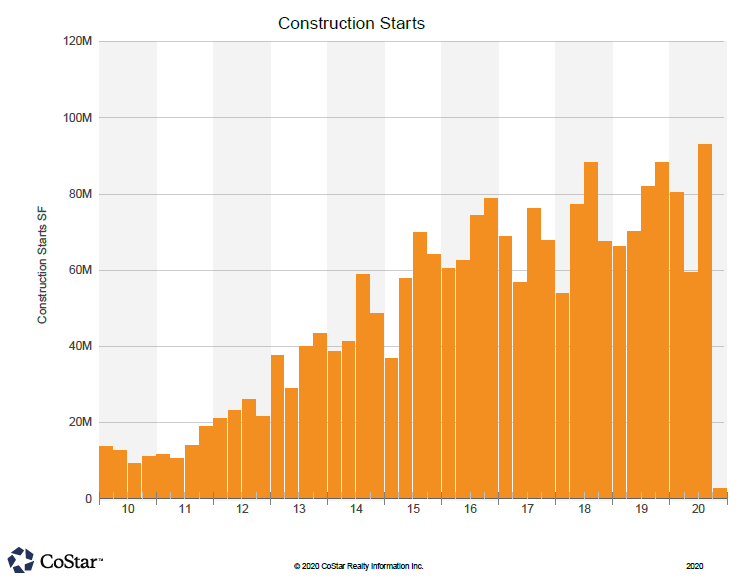

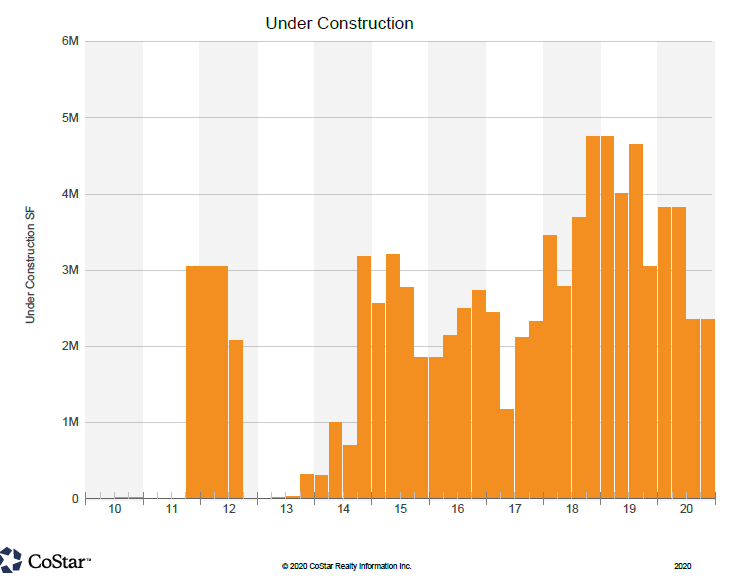

Industrial Real Estate Trends and Tracking

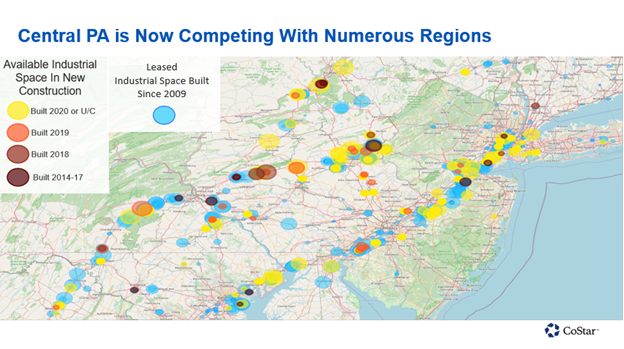

When we look at the largest industrial leases in Pennsylvania, we can quickly identify the strength of the Central Pennsylvania region and the I-80 Corridor, much of which is occupied by e-commerce businesses.

What’s also interesting to see when mapped out is how the most concentrated industrial real estate markets tend to follow the major roadways, which is what fuels manufacturing, warehousing, and distribution. Quick and convenient access to these roadways is essential for e-commerce businesses who need to deliver product to customers quickly and efficiently.

And with one more graph, we can appreciate the peaks and valleys of constantly shifting vacancies in industrial real estate throughout the Central PA region, the most volatile being Lebanon and most steady being York.

Major Takeaways

The longer the pandemic drags on, the more likely that consumers stick to their new habits. Companies are racing to adapt. The stakes are high, especially for small businesses that were slow to embrace the e-commerce trend and are now desperately trying to catch up. Previously, many retailers might have said e-commerce is a relatively small part of the overall business, maybe 10%. Now that’s grown dramatically to 30% or 40% plus for many retailers and heading into the holiday season with most likely record-setting online sales, businesses who relied on foot-traffic are not likely to rise with the tide.

Even e-commerce giants can’t afford a misstep. This is a pivotal year for all retail and industrial businesses wh rely on manufacturing, storage, and distribution of product to bolster sales. Those who were not prepared for the major shift to online shopping this holiday season will feel it in their bottom line. For those who have not already adapted, the best time is and will always be ‘now.’