When COVID-19 hit and the U.S. went into full lockdown, consumer spending took a sharp turn. Heading out to restaurants, bars, concerts, or the movies was no longer an option. Even now, nine months later, we are far from returning to how things were. The general public is wary or deterred by new policies like limited capacity, wearing face masks, and social distancing. This has all had a profound impact on how we’re spending our money, particularly on services or experiences. Instead, we’ve shifted our spending to physical goods to find other means of entertainment and enjoyment, and to make our homes more comfortable, because we’re spending considerably more time at home.

Considering all of this, plus the fact that 10+ million Americans are still jobless, the sluggish recovery of consumer spending on services is cause for concern. At the same time, retailers selling goods, especially online and through contact-free delivery, are in a position to grow their market share. Keep reading to learn how COVID-19 has had an uneven impact on spending, and what this might mean for our economy and commercial real estate long-term.

Spending Shifts from Services to Goods

Based on data from U.S. Bureau of Economic Analysis, spending on goods quickly recovered from the initial shock of the pandemic, returning to growth as early as June. But consumer spending on services is still more than 6 percent off pre-pandemic levels.

The reasoning behind these numbers is straightforward. As the pandemic severely limited people’s option to spend money on services such as dining out, traveling, and other leisurely activities, their spending shifted to physical goods because this was both more accessible and deemed the safer option for enjoyment and entertainment. People weren’t visiting public pools or taking vacations, so spending on items like swimming pools, bicycles, kayaks, etc. skyrocketed. For many retailers, these items were out of stock nearly all summer.

Furthermore, people began reallocating discretionary income formerly used for travel and entertainment to home improvements and renovations. We saw things like new appliances, cabinetry, and mattresses run out of stock while hotels, restaurants, casinos, and event venues sit vacant.

A Double-Edged Sword for Economic Recovery

While it’s certainly positive to see overall spending levels recover relatively quickly, the slow recovery of consumer spending on services is concerning for several reasons. First, the United States is a service economy, as the U.S. GDP reveals. In 2019, personal consumption expenditure on services accounted for 47 percent of the gross domestic product, making it by far the biggest contributor to the country’s economic output.

As the following chart shows, clothing and accessories stores experienced a 30 percent decline in sales compared to the same period of 2019. Similarly, food services and drinking places were hit with a 20 percent spending decline compared to last year’s total. Department stores and electronics experienced a 15 percent decline through three quarters of 2020.

At the other end of the spectrum, non-store retailers, building material and garden dealers, as well as grocery stores, have seen double-digit growth rates in the first nine months of 2020, as consumers shifted much of their spending online and outdoor activities boomed in face of the COVID-19 threat.

What This Means for Retail Locations

Some industries have found ways to safely reopen with limited capacity and new policies in place such as social distancing and mandating facemasks be worn. But even nine months after the start of the pandemic, things are far from “normal” and this includes bottom-line sales. Restaurants, bars, and hotels can only operate at 50% capacity or less which is a huge blow to the amount of business they can do in any given week or month. And shopping at retail locations is quickly being replaced by online shopping.

While some retailers have been able to accommodate customers online, many others, particularly small businesses and boutiques, were not equipped to make this shift. For businesses already on the brink of making ends meet, the pandemic was the straw, rather the wrecking ball, that broke the camel’s back. We see shopping centers with major vacancies and entire chains of corporate stores and restaurants bow out of business.

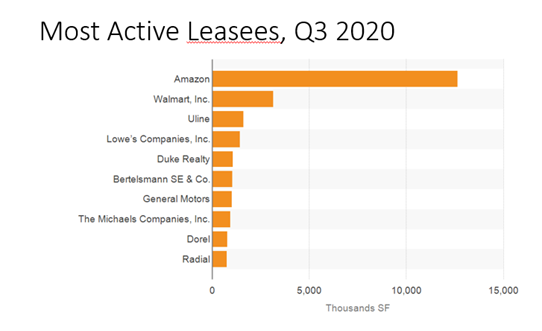

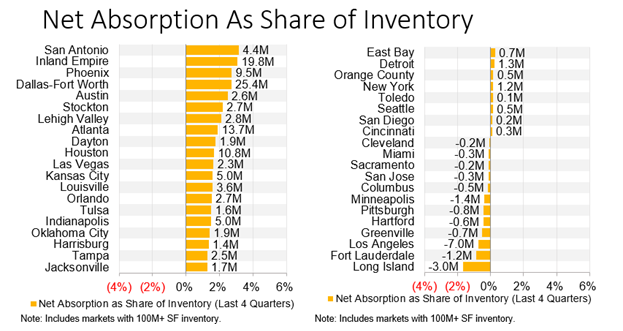

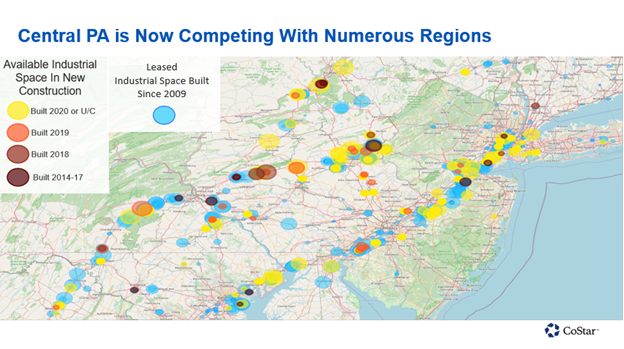

For commercial real estate, especially shopping centers and malls, the future is bleak. In contrast industrial real estate is rising in demand because of big online retailers needing to increase their storage and rapid distribution. People want their essentials (and even non-essentials) delivered quickly to their door-step. With businesses like Amazon offering free 2-day delivery for most items, ample and accessible storage facilities have never been more important.

And for consumers, the biggest takeaway from this major shift in spending is to be mindful and intentional about how and where you invest your resources. How we spend impacts the economy. Though you may hear phrases like “shop local” and think your individual spending is just a drop in the bucket, when all those drops are put together, it has a large impact. For those that don’t feel comfortable dining out, you can still support your local restaurants through takeout or delivery. And if you don’t desire shopping in-store, consider supporting small businesses through curbside pick-up or having items shipped to your home. Our collective spending habits today, even amidst a pandemic, are painting the picture of our economy well into the future.

Even after the impact of COVID-19 on the economy begins to correct itself, what do you think the impact on consumer spending will be long-term? Comments are welcome below!