In the span of about one week, both Rite Aid and Harsco made the major announcement that they would be transitioning their headquarters out of Central Pennsylvania and into Philadelphia. These major companies account for significant commercial office space and even more local jobs that now hang in the balance. The physical space is the most obvious asset to become vacated in the move. Rite Aid accounts for 205,000 square feet of space located at 30 Hunter Lane in Camp Hill. And Harsco currently occupies approximately 40,000 square feet of space located at 350 Poplar Church Road in Camp Hill. The relocation of these two company headquarters will result in an increase in vacancy in the Harrisburg West Submarket from 10% to 12.45%. In addition to physical space, local jobs, particularly the ones that are not conducive to a virtual work environment, are uncertain to make the transition.

According to the information shared in the official announcements from both Rite Aid and Harsco, we learned some valuable information about the plans for the transition, what fueled their decision, and how this stands to impact local jobs immediately and into the future. Keep reading to learn what these reasons are, how COVID-19 plays a role (or didn’t), and what this could predict of other companies choosing to do the same in the future.

Remote-First Work Approach

According to Fox News, Rite Aid is transitioning to a “remote-first work approach for corporate associates. Rite Aid stated that they had been closely monitoring associates who have been successfully working remotely since the early days of the pandemic. This provided valuable insight into how employees viewed this flexible style of work and the results it yielded. An internal survey found that a vast majority of these associates preferred working from home and found themselves to be more productive in their work.

Conversely, Harsco’s plans do not call for a hybrid workplace. Their new location is in the center of the city in Philadelphia and current plans point to transitioning back to working face-to-face.

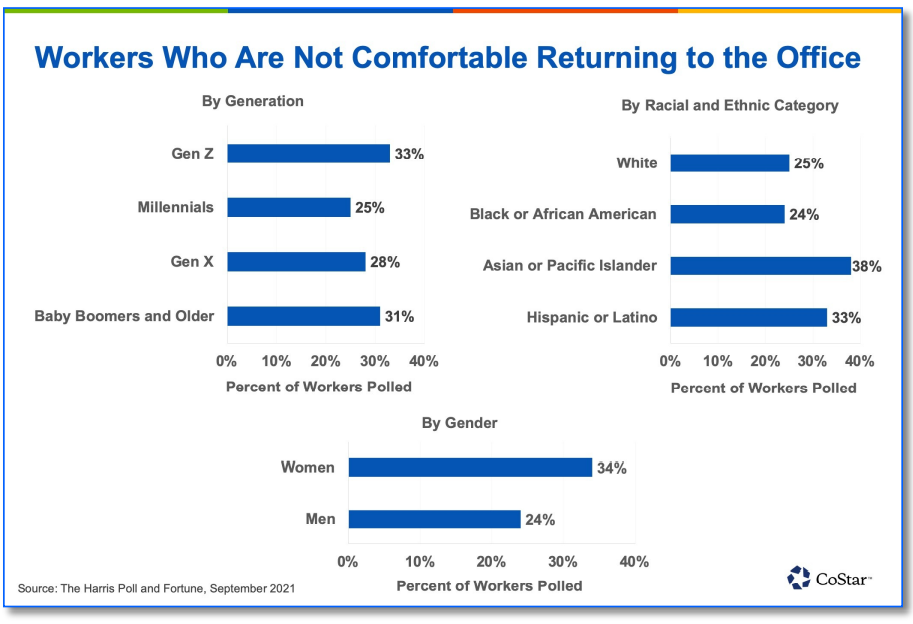

Interestingly, a recent CoStar survey examined employee readiness to return to a physical work environment. Though the majority of workers responded that they were “somewhat okay” with returning to the office, a notable number of people expressed hesitation and concern about returning to work. Broken down by generation, ethnicity, and gender, the results look like this.

Rite Aid’s focus on moving to a new headquarters that accommodates an effective remote-first work approach makes sense. They are listening to the preferences (and hesitations) of their employees and using this as an opportunity to transition to a work style that fits the style of their team now and into the future.

The Appeal of Collaboration Space

Allowing for more employees to work remotely doesn’t fully explain why Rite Aid would pull its headquarters from Camp Hill and move to a more expensive market like Philadelphia. But maybe this will. In its official announcement, Rite Aid explained that its new model for use of its physical locations would be supported by a network of collaboration centers throughout the company’s geographic footprint. Its official headquarters in Philadelphia is a space specifically designed for in-person collaboration and company gatherings, instead of office spaces. This means what while more employees than ever will be working remotely when they do need to come together, the space they have is conducive for effective collaboration.

Both Companies’ Draw to Larger and Diverse Talent Pool

As is often said in real estate, it’s all about location, location, location. The new Rite Aid headquarters will be in Philadelphia’s Navy Yard district, an area that the city has been building up rapidly in recent years. This is an attractive area for a business because of its surrounding talent pool that is growing as rapidly as its new and accommodating options for office space. When hiring for positions that require in-person work, Rite Aid will now attract talent from the greater Philadelphia market as opposed to the more rural and much smaller Central Pennsylvania market.

Harsco, the company which was established in 1853 as the Harrisburg Car Company, operates in more than 30 counties and employs 12,000 people, but only about 100 in the Harrisburg area. Quite simply, it has outgrown this market. According to CBS21 News, Nick Grasberger, Chairman and CEO of Harsco Corporation says “We are confident that this move to America’s sixth-largest city will provide us with more options to the future resources needed to fuel our growth.”

Closer Proximity to Customers and Federal Government Agencies

One more reason Rite Aid shared for its decision to move its headquarters is its desire to be more centrally located to its customer base as well as federal government agencies. Philadelphia is a much larger market, sixth in the nation in fact, so there is little argument that its new headquarters will place it closer to a larger customer base, especially one that is urban and with greater diversity.

Speaking to the federal government agencies point, both companies are located within close proximity to state government, with the capital city right over the bridge from current headquarters in Camp Hill. The move is not to say that state issues and the connections made in Central PA are not of value, but it appears both have eyes on national growth. Making the decision now to move to a location with more federal government representation and connections is a strategic decision for the future.

What this Means for Central PA

Though the loss of the headquarters of two sizeable companies, both within a very close time frame, comes as a notable blow to Central PA, there may be a silver lining in all of this. Both companies were intentional about addressing the concern over lost jobs and focused on their intent to preserve as many local jobs as possible during the transition while opening up new avenues for job creation. The actual impact on local jobs remains to be seen, and with that comes the trickle-down impact on other industries such as hotels, restaurants, and retail stores that rely on the business from individuals who live, work, and play in Central PA.

Additionally, the loss of Rite Aid and Harsco will create a significant vacancy in commercial real estate in the local market. It remains to be seen what will become of their vacated space and what business will ultimately make use of it. With every loss comes opportunity. Whatever business moves into this space also brings the potential for jobs and economic growth. On the bright side, both companies have chosen to maintain headquarters in Pennsylvania which is better than moving outside the borders to a neighboring state. Both anticipate being in their new Philadelphia offices by 2023, providing ample notice for transition both for the business as well as for the Central PA and Philadelphia markets.