Logistics is the relay race that materials and goods compete in every day moving across land, sea, and air cargo to the end-user, and commercial real estate is the field on which it all plays out.

The ability for the items we need to make it from the place in which they are created to where the end-user can access them is essential to our existence. When logistics are inefficient or disrupted on even the smallest scale, it takes virtually no time until the world feels the impact of delayed goods. At a minimum, it’s an inconvenience, but it can quickly escalate into a global panic where progress is delayed and prices skyrocket.

We need no better example as to how this plays out in real life than to look at the impact of COVID-19 on the world’s shipping and distribution, specifically here in the United States. The challenges we continue to face with shipping and receiving items overseas, combined with unprecedented labor shortages have caused scarcity, unlike anything our modern world is used to. And the ripples caused by this disruption left virtually no industry unscathed.

This also shines a spotlight on the importance of last mile logistics, which is the final step of the delivery process from a distribution center or facility to the end-user. Many items delayed by COVID-19 were within miles of reach, but without labor and infrastructure to deliver these items within their usual time frame, basic building materials and household items couldn’t be restocked fast enough to keep shelves full.

Shifting the Modern Logistics Model

How does this relate to commercial real estate? Redundancy and the ability to process disruption are two key elements required to support the fast-moving, high-volume requirements of modern-day logistics. And that is particularly true of the “shop-online-and-deliver-to-me” era in which we find ourselves.

Based upon the challenging lessons learned from the global pandemic, logistics are shifting toward a new model that replaces the decades-old “just-in-time” supply-chain model rooted in tens of thousands of physical retail stores in order to meet the demands of a “shop and take home” economy. Therefore, we should expect to see a disruption in commercial real estate demand and use. There will be less dependency on physical stores and more on modern eCommerce warehouses that will be increasingly automated with less reliance on labor.

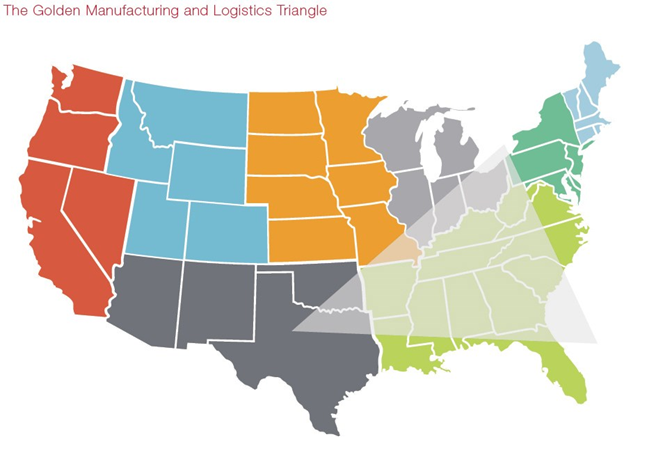

The Golden Triangle

We can then expect the rapid continuation of traditional retail big-box stores being replaced by hundreds of millions of square feet of eCommerce warehouses in an effort to follow the modern logistics infrastructure. These new eCommerce warehouse locations are being developed in what some economists have coined as the “Golden Triangle.” The Golden Triangle refers to an area of the East Midlands that has become renowned for its high density of distribution facilities and being home to some of the biggest names in retail.

The Golden Triangle is the epicenter of last mile logistics. This area that makes up the nation’s logistics infrastructure has never been more vital in a post-WWII era, and this includes a dependency on commercial real estate. As thousands of retail stores shutter their brick and mortar locations in the coming months, the demand for commercial real estate space shifts from retail to industrial with thousands of new logistics and eCommerce fulfillment warehouses opening and expanding within the Golden Triangle.

Impact of Current Events

These trends in commercial real estate and logistics will be further exacerbated by current events such as Biden’s plan for a “go-broad” infrastructure bill. This plan proposes a massive $2.25 trillion to fix America’s rundown infrastructure, “green up” the economy and invest in new technologies. Furthermore, there is the pending mega rail merger between Kansas City Southern and Canadian National that will create the first true Class 1 railroad in North America extending from the deep interior of Canada, down through the center of the United States, and on south to the most vital ports and manufacturing regions in Mexico.

And if that wasn’t enough to ensure massive changes coming down the line that will impact commercial real estate and logistics, there is also the industrial REIT merger between Monmouth MREIC and Sam Zell’s EQC in which he is trading in his office commercial real estate model for a new hybrid-powered industrial real estate model that is going all-in on logistics.

What we’re witnessing is a shattered economy that is rapidly adjusting in order to right the many ships that have veered off course in the wake of the pandemic. While there are many unknowns, what we can be sure to expect is widespread, lasting changes sweeping the commercial real estate market – some we’ve seen coming for quite a while, and others that will completely take us by storm.