Note: This article was published by the Central Penn Business Journal. Click here to read the original version.

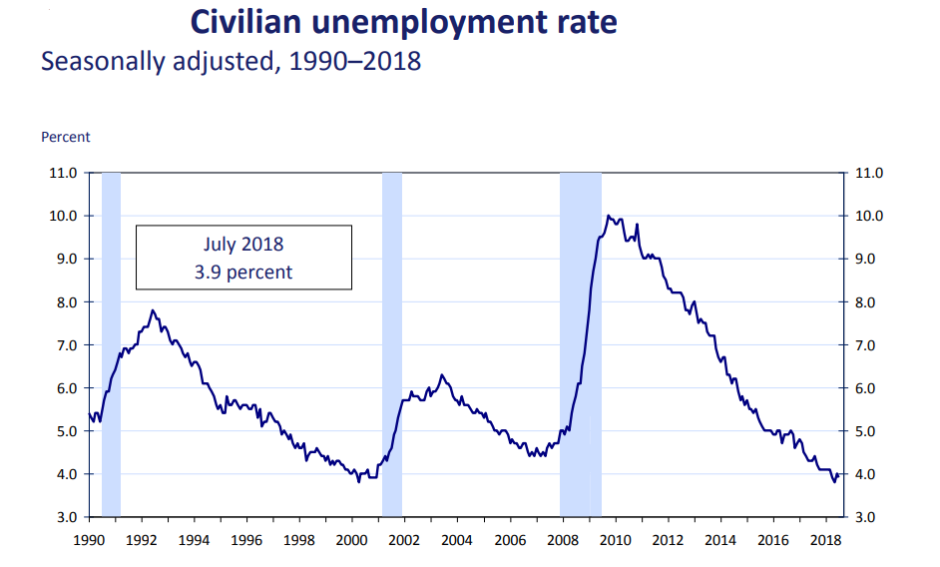

Earlier this month, it was reported that the number of Americans filing for unemployment benefits rose less than expected. To put this into perspective, claims dropped to 208,000 during the week of July 14, which was the lowest it has been since December 1969! After peaking at nearly 300,000 claims in October of 2017, we have seen a mostly steady (with some variation) decline in unemployment claims moving forward.

Dropping unemployment numbers indicate a strong labor market. The United States has an estimated 149 million jobs – 19 million more than it did just nine years ago. When you think about that type of job growth, it’s easy to see how it will have an impact on commercial real estate. To accommodate 19 million more workers, businesses have had to add space. Even for jobs that are run outside of traditional office space, there are still many more that do utilize office, retail or industrial real estate to some capacity.

Source: Bureau of Labor Statistics

Many people may assume that it’s the economy that drives commercial real estate activity, but really it’s jobs. The two are closely correlated, but for several compelling reasons jobs have the greater impact and drive businesses to either expand or contract their commercial space.

It all comes down to people and space.

Economic growth is measured by GDP and can be fueled by any number of factors, most of which won’t have a direct impact on commercial real estate. Businesses can earn more money without necessarily needing to hire more people or move into a different commercial location. Though it’s common that when the economy is growing, the commercial real estate industry becomes more active, the true driving force is jobs.

When businesses need more people, they also need more space to accommodate these people. A business using traditional office space is not likely able to hire more than three or so people before working quarters begin to feel a bit crammed. As a result, they move. It is increasing jobs, not just economy, that spurs new commercial real estate activity.

Change doesn’t happen overnight.

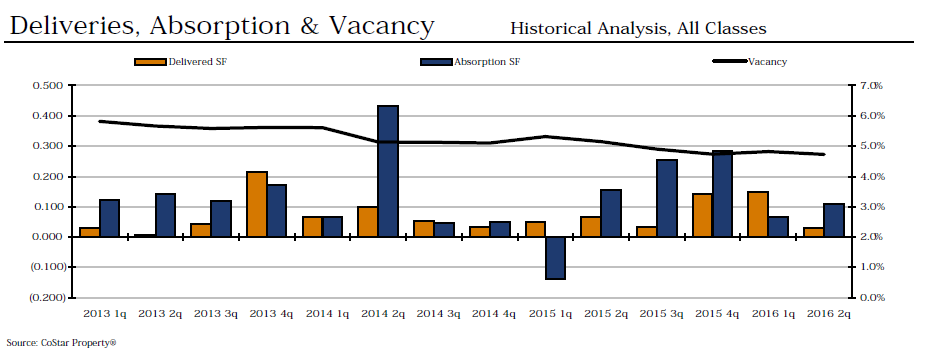

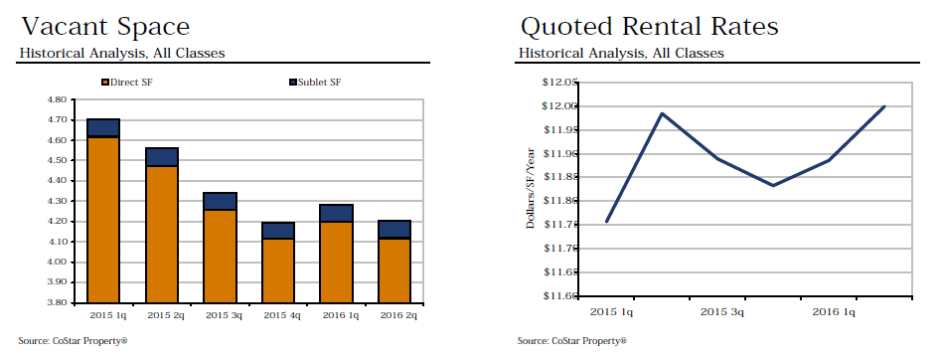

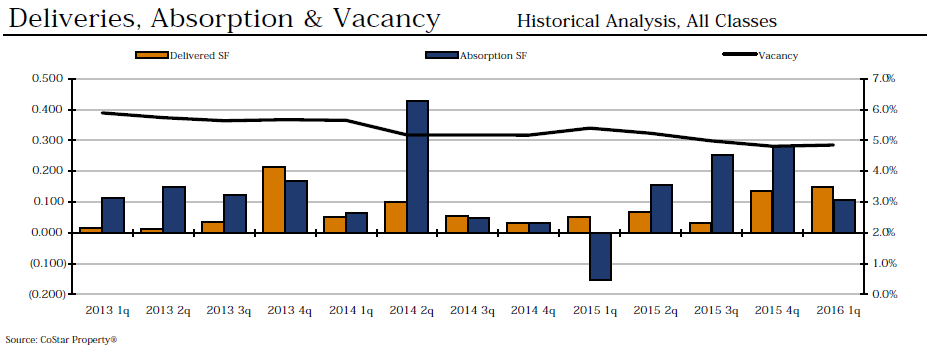

There is somewhat of a long tail on job growth driving commercial real estate activity. It takes time to catch up! When businesses are adding employees, they will usually make their current space “work” for as long as possible and then strategically move into a bigger space when they absolutely must. Conversely, when businesses are forced to lay off employees, they often stay in their current space, even if it means some space goes unused. The reason is it’s easier (and less expensive) to lay off employees as the first means of cutting costs than it is to downsize commercial space.

So, the job growth that we’ve seen over the course of many years is now driving the commercial real estate activity we are seeing today.

Slowing, but not stopping.

Job growth peaked in early 2015, then fell steadily through the end of 2017. Since then we have seen a modest, yet mostly steady increase in recent months. The reality is job growth, at any rate, cannot go on forever. The reason is, at some point, the United States will reach its “full employment” where everyone who wants a job, has a job. The unemployment rate, now at 4%, is about as low as it has been since the late 1960s, almost 50 years ago.

For commercial real estate, the link between job growth and space demand is clear and direct, though there may be lags. There will always be businesses who are looking to change their commercial space. Some will want more space, some will want less. Others will want to move to a newer space or will desire a different location. Businesses will close while others open. And so the cycle continues.

Short-Term Impact

Even with economic growth heating up, commercial real estate investors and property owners should not set their expectations for greater space absorption too high, at least in the short-term. Yes, there will be some pick-up in leasing associated with the spike in GDP growth. However, CRE professionals would be wise to focus more on job growth as the gauge for leasing prospects – and this outlook looks much more moderate because the ranks of unemployed workers available is largely exhausted. Looking at the short-term, we should not anticipate significant growth in property leasing this year. The surging industrial sector is the exception, which is the result of the shift from in-store to online shopping, not jobs.

Do you agree that it’s jobs, not the economy, that has the greater impact on commercial real estate activity? Why or why not? Join in the conversation by leaving a comment below.