What does the major shift to virtual offices mean for commercial real estate?

All across our nation, businesses that once functioned from physical office space had to quickly transform their processes to function remotely as the government mandated stay-at-home orders to prevent the spread of the Coronavirus. This proved to be a strenuous and uncomfortable transition for most businesses, regardless of size or structure. Businesses with just a handful of employees, all the way up to organizations and institutions with thousands of employees scrambled to piece together the technologies and protocol that would allow them to remain functional, even when separated physically.

The typical boardroom meetings turned into Zoom calls, workshops and trainings that were to be conducted in-person, needed to mold into virtual delivery, and much more. As is to be expected, there was a steep learning curve and many technological challenges to overcome.

Now that Pennsylvania is more than a month into its statewide stay-at-home orders, many businesses have found new normal of working virtually. This is encouraging for those businesses who have managed to survive, and even thrive amidst such volatile times for our economy. However, it presents an uncertainty as to how businesses will choose to resume their traditional work environment, when they have permission to do so.

The Impact on Commercial Office Space – Nationally

Before COVID-19, around 43% of workers “occasionally” worked from home [versus 39% in 2012], 62% of workers said they could work remotely, and 80% of workers wanted to work from home at least “some of the time.” Working (remotely) through this pandemic will likely increase those percentages, spelling rough waters ahead for office landlords. Now during the stay-at-home and work-from-home orders, employers are seeing how they can operate with some or all their employees working remotely, and even do so as or more efficiently than when working from their traditional work environment.

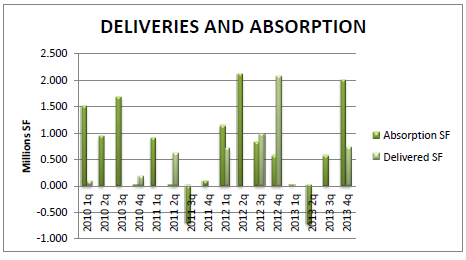

As a result, it’s likely many employers will closely consider how they might leverage the cost-savings associated with reducing or completely eliminating the overhead of physical office space, which will result in increased office space vacancies, shorter leases, reduction of space needs from renewing tenants and less money available for tenant improvements. Vacancies will rise dramatically before they slowly decline. With approximately 8.1 billion square feet of office space nationally, the expected addition of another 335 million square feet through 2024 is very much in doubt.

The Impact on Commercial Office Space – Locally

Being the home of Pennsylvania’s capital will provide the Central PA region with some shelter, but there is little chance this market does not cool in the very near future. Employment gains have underperformed the national average for the duration of this cycle, and demographic trends are unfavorable. Residents are older, population growth is slow, and the state’s fiscal situation is, quite frankly, a mess.

Harrisburg is an underdeveloped capital compared to Columbus, Albany, and Annapolis; and the cultural epicenter of central Pennsylvania is in Lancaster. Harrisburg is trying to evolve into a knowledge-based economy and has adopted business-friendly incentives that have helped create nearly two dozen tech startups, which have generated 1,000 jobs. But the backbone of the economy still lies with Hershey and Rite Aid, which have headquarters in the region.

Fortunately, Central PA also has a strong education and medical economy that is reflective of statewide employment. Education and health services jobs, which now track evenly with government jobs in the state’s capital, grew by more than 4% annually. Expanding employment opportunities have increased demand for office space, and employment in office-using industries is well above pre-recession figures; but this remains, and likely will remain, a slow-growth market. Additionally, Pennsylvania as a whole will likely face significant financial problems after the virus subsides.

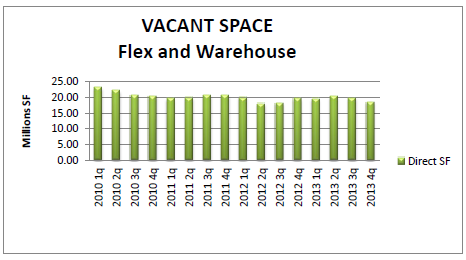

Vacancies currently sit at close to 6.6%, representing a year over year change of 0.0%, but are almost certain to spike in the very near future. While 12 month absorption figures (9,300 square-feet) can be negative, vacancies remain under control thanks to limited levels of new supply. The limited demand, and high number of small businesses operating here, could hamper the city for years if the quarantine carries on for months, as the federal government is estimating it will.

A New Work-From-Home Paradigm

When it comes to navigating the new work-from-home paradigm, we can expect “work-from-home” policies to be established to assure proper decorum, productivity standards, communication, and online protocols. Also watch for the adoption of four-day work weeks, shorter workdays, and greater reliance on technology for current employees. Extensions of sick leave “banking” and “healthy-to-come-to-work” standards are likely to become commonplace.

From the tech side of things, the use of platforms like Zoom, Go To Meeting and Blue Jeans video conferencing technology will become more popular alternatives than traditional in-person meetings. There will also be an increased expectation that these meetings will be as, or more productive than in-person meetings. Board management software and other secure online document management such as DocuSign, DropBox, and shared drives could electronically account for 70% – 75% of all “approval” transactions, for businesses who require such. Robust CRM (customer relationship management) platforms will be used increasingly to interact with customers and clients. Additionally, automation and outsourcing could replace 20% – 30% of employees who perform clerical, accounting, and administrative functions.

A Looming Recession

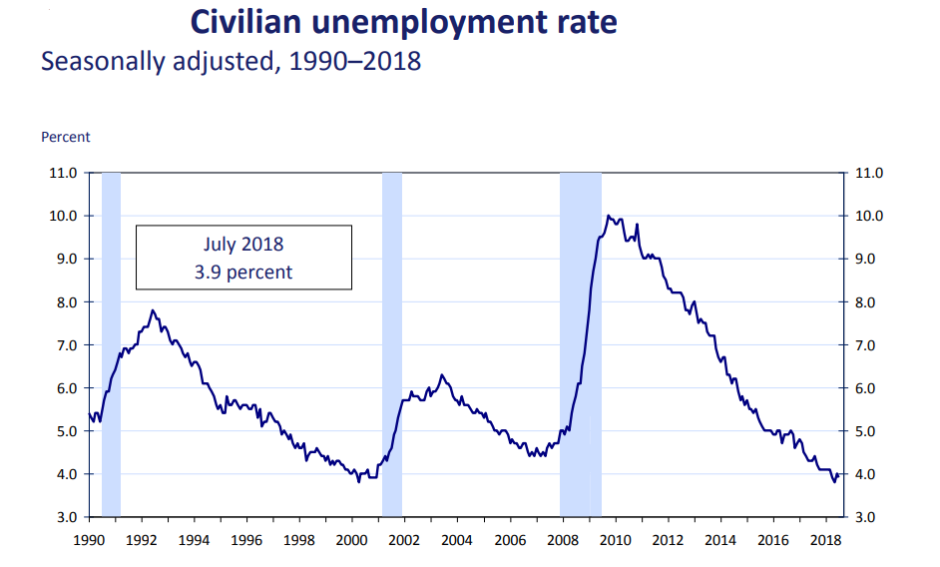

No matter how you look at things, the bottom line is that this pandemic will push the U.S. into a recession. There’s simply no way around it, at least immediately. Overall GDP growth in 2020 is expected to decline 10% – 13% which is the deepest recession on record. Some expect unemployment could rise to 10% – 15%, or higher, assuming a COVID-19 peak occurs by the 3Q.

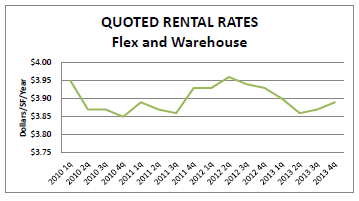

The Central PA region has been significantly impacted by the Coronavirus. As of first quarter, the country closed up businesses and the federal government is estimating it will take months before there is a return to normalcy. There is no telling how long the shut out will occur, or what impact it could have on the Central PA office market, though it will likely be immense. Unemployment numbers are beginning to spike, and in the coming weeks, it is likely that hundreds of more businesses could fail, even with the Governor’s promise of reopening the Commonwealth on May 8. Additionally, rents will likely decline as vacancies skyrocket, and construction and investment activity will likely remain extraordinarily limited through the remainder of 2020.

The fundamentals of how Americans live, work, shop and play have changed and will not return to historical norms of behavior, consumption and lifestyles. The year 2020 will be analogous to the impacts of and transformative changes resulting from the Great Depression [1929 – 1932], which took more than 10 years to recover.

Where do we go from here?

Commercial real estate must look at this as an opportunity, just like every industry, to pause and pivot. The market prior to COVID-19 will not be the same market to which we will return. But we will return to something and we must learn to navigate this new landscape by remaining flexible, thoughtful, and strategic. Historically, Central PA has been able to withstand some of the most tumultuous economic storms on the past. Yes, gains are about to take a hard hit as the Coronavirus tears through the commercial real estate world, but this only means we need to bear down an be open to opportunities wherever they may arise.

One of the hardest hit areas of commercial real estate will be new construction. With little supply underway at second quarter, and the Coronavirus halting construction across the world, there is very little chance this market sees any notable projects deliver this year. Most projects since 2015 have either been build-to-suit efforts or significantly pre-leased prior to ground break.

With most new construction on hold, there could be the opportunity for existing office renovations. Many businesses may be looking to reconfigure their space to better isolate employees, adhere to whatever new social distancing protocols come from this, or install sanitary features like air purifying systems. Commercial real estate construction companies and developers would be wise to shift their focus to this type of work.

Another hard hit sector will be companies that provide shared and collaborative office space, like WeWork. In fact, society as a whole is likely to question the open office, collaborative work space, and creative office floor plans. Many businesses and sole proprietors chose to cancel their memberships to such services during the pandemic and it will be exceptionally challenging to regain all that was lost once the stay-at-home orders are lifted. For those who have found that they can effectively work from their own home office spaces, they may continue to do so in an effort to lighten overhead costs. Others may have been hit so hard by the pandemic that there is not a business to which they can return, further reducing their need for office space.

Again, the opportunity here is to reconfigure both the physical shared office spaces to be better isolated and sanitary, but also rethink the business model of how companies charge for space. Being flexible and fluid for business owners as they navigate the new normal is key right now.

To close on a positive not, the one clear winner in the office sector will be healthcare, medical office buildings, and biotech facilities. This sector is expected to grow 10% – 16% annually over the next decade as the entire local, county, state, and national healthcare facilities infrastructure and platform are reshaped, integrated and expanded as society mends and strengths as a result of a pandemic like the world has never seen.

If you are a commercial real estate professional, how have you been impacted thus far by COVID-19. Or if you are a business owner or employee who has transitioned to a virtual work environment, how do you anticipate this experience to transition your “new normal” once the stay-at-home order is lifted?

Join in the conversation by leaving a comment below.