Commercial real estate lending, the bread-and-butter business for many smaller and regional banks, could further decrease in 2020. The cause is a combination of a few different factors – intense competition from non-bank lenders and rising delinquency rates to name a few. Mortgage lending is also predicted to be impacted by rising interest rates and tight housing supplies in many major markets.

This trend is not new, but rather has been slowly creeping in for years. In 2017, U.S. banks reported that demand for commercial real estate loans weakened in the second quarter, though foreign banks reported strengthened demand. Furthermore, loan growth slowed to 4.2 percent in 2018, down from 5.6 percent in 2017, according to bank call reports and Federal Deposit Insurance Corp. data.

Why exactly are banks cutting back on commercial real estate lending? And should this call for concern that a potential economic downturn is in the near future?

To lend some expertise on this topic, Omni Realty Group turned to Rory Ritrievi. Rory has more than three decades of experience in banking, specifically in Pennsylvania. For the last 11 years, Rory has served as President and CEO of Mid Penn Bank. Under his direction, the bank has grown from $550 million in assets and 14 retail locations to over $2 billion in assets and 39 retail locations.

Throughout his banking career, Rory has gained deep insight into when and why banks provide commercial real estate loans – and when they do not. Let’s learn what he thinks is going on in the current market, and the pending economic impact.

Omni Realty: How has commercial lending changed in the last 5 years?

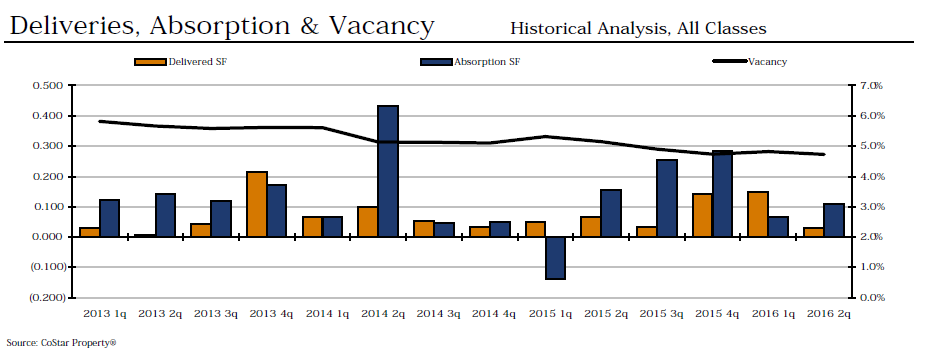

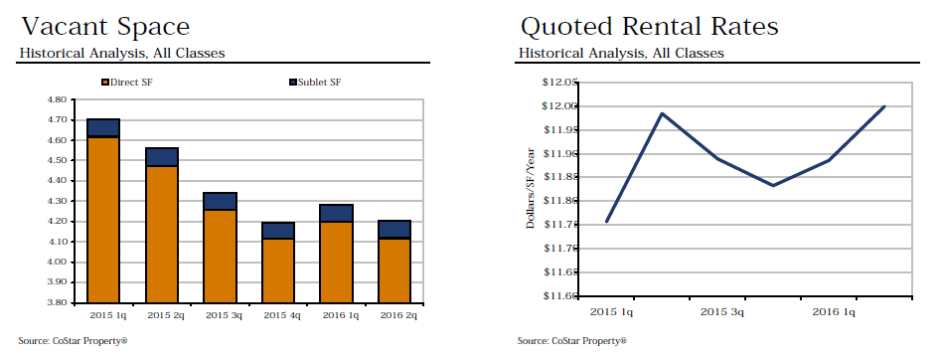

RR: In the last 5-10 years, we have seen, for the most part, a return to credit fundamentals that seem to have been abandoned in the years leading up to the Great Recession. Back then it seemed like almost any deal made sense to Bankers. Now, the focus has been returned to analysis of absorption rates, discounted cash flows, borrower experience, reasonable cap rates, and strength of guarantors.

Omni Realty: In your opinion, what are the main causes of these changes?

RR: Losses. Loan losses of 2008-2012 gave a renewed focus to bankers on the true meaning of credit fundamentals.

Omni Realty: What changes would need to take place in the commercial estate market, or economy as a whole, to further improve commercial lending?

RR: Lenders need to evolve their underwriting and analytics to keep up with the evolving demographics. Baby Boomers are aging out so there is a need for more senior housing, multifamily rentals, luxury apartments, and assisted living. Additionally, high student loan balances are making the need for affordable housing in urban areas more prevalent. There is also a growing focus on renewable energy and green spaces. Finally, work from home is more prevalent which challenges the demand for traditional office space. When we look to retail, the shift toward online decreases the demand for mall space, while increasing demand for warehouse space. And we can’t overlook technology. Bankers need to not only know about emerging technology that stands to impact the market, but they must embrace it as a highly valuable tool to help them “keep up.”

Omni Realty: What do you anticipate the trend to be for commercial lending in 2020?

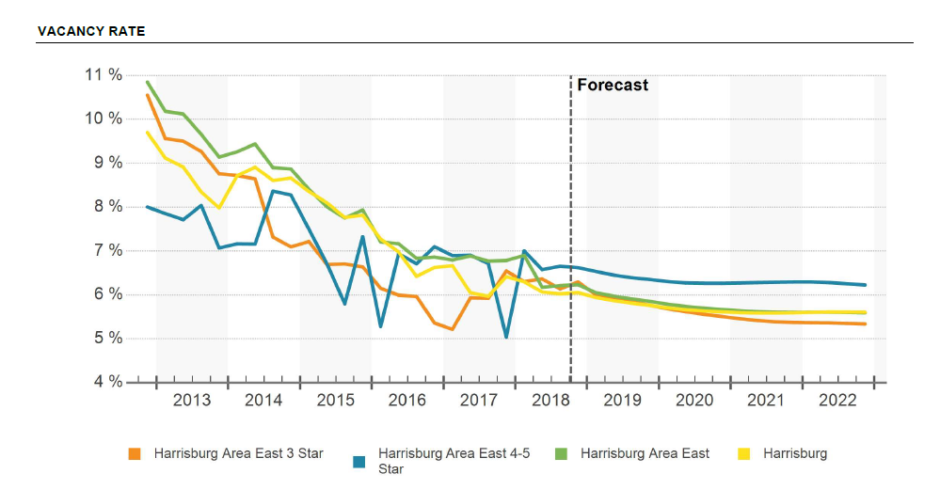

RR: In my opinion, 2020 will be a positive year in the lending business, particularly in Central Pennsylvania. We are in a good credit cycle and the interest rate yield curve is in decent shape compared to last year. There are geopolitical issues such as the impact of the general election, instability in the Middle East, and trade with China but I do not believe any of those issues will halt the progress of our local economy in 2020. Challenge it, yes and maybe slow it a bit, but not halt it entirely.

Omni Realty Group thanks Rory for sharing this valuable information and helping us to further understand the factors impacting how banks view commercial lending. Though banks are, for the most part, treading lightly in the market since the Great Recession, it’s encouraging to hear their renewed commitment to credit fundamentals, and helping both individuals and businesses make well-educated lending decisions.

Amidst a year that will no doubt bring change, it’s important we remain aware of the lasting impact factors such as elections and geopolitical issues may bring to our economy, both immediately and for years to come. Rory provides sound reason as to why we should not fear such changes, but rather maintain confidence in the banking economy, particularly here in Central Pennsylvania.

Do you agree with these insights, or have others to share? We welcome your feedback in the comments below!

According to the data from the

According to the data from the