As shared by the Central Penn Business Journal, the Hershey-Pinnacle merger was recently opposed by the Federal Trade Commission (FTC) and the Pennsylvania Attorney General’s Office. The reason for this decision was explained as the Dauphin County-based hospitals are direct competitors, and that their union would eliminate competition in the Harrisburg region. For Harrisburg area residents and employers, a reduction in (or elimination of) competition may result in lower quality and higher cost health care.

While this ruling is a huge blow to what PinnacleHealth and Hershey Medical Center surely felt was a smart business move, it’s not likely stop the two entities’ from pursing alternative business growth opportunities.

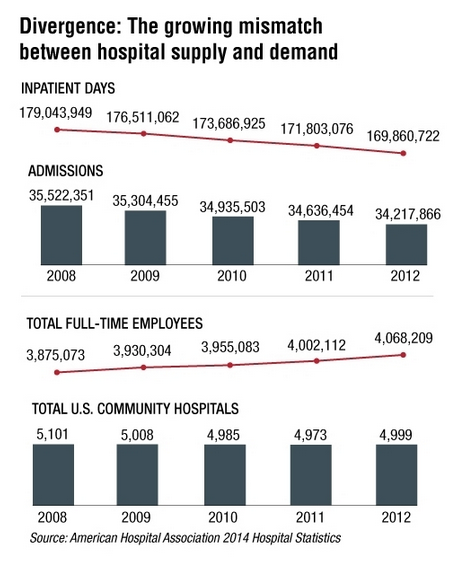

The ACA has made the healthcare environment a market share game. So health systems are pursuing volume drivers for their systems, which means putting primary care and urgent care clinics in strategic locations. Among the popular pathways to growth for hospitals and health systems, we expect to see Pinnacle Health and Hershey Medical Center employ some or all of the following opportunities in the near future.

- Increase in ambulatory care facilities (i.e. freestanding urgent care, outpatient surgery and imaging centers and emergency care centers). Out-patient centers are an important and cost-effective alternative to higher cost inpatient-focused acute strategies. A health system can greatly increase the number of patients it can see and treat in a day through the operation of freestanding urgent care locations. This follows the trend of the new hub and spoke healthcare delivery model where the hub of a single network branches out into various locations to increase accessibility and efficiency.

- Recruitment or acquisition of medical groups that are in-market, but not fully aligned with the hospital. As healthcare reform continues, the number of insured patients seeking access to care will also increase. Therefore, it’s important for a health system to have the added capacity to monetize this growth. Additionally, patients often choose to follow their physicians regardless of hospital affiliation, meaning those with the most aligned physicians will grow the most.

- Clinical program development and service expansions or extensions. Health systems that actively seek opportunities to expand the scope of services they provide, such as adding new procedures, diagnostic categories, or subspecialties into their portfolio, are well positioned for growth. The complexity of healthcare and health insurance incentivizes patients to seek all of their care from a single organization, when possible. The more services a health system provides, the less likely a patient will seek care from a competing network.

- Geographic market expansion to establish additional locations of care. More and more, healthcare is beginning to look and act like typical retail marketplaces. One example is a preference for convenient venues and access locations. Health systems that extend their reach geographically can raise their growth trajectory. Most importantly, each location should consider its targeted populations so that the services provided meet the most common demands of that specific area.

- Merger or acquisition of another hospital or health system (including assets, “book-of-business,” and affiliated provider network). Establishing new locations through merger or acquisition is a fast track to growth. While the Hershey-Pinnacle merger was shot down, it’s not unlikely that they will seek out other possible mergers that do not conflict in the same way. Let’s face it, mergers provide a lot of benefits, including access to efficiencies through combining resources, and the opportunity to grow market position in key centers of excellence, institutes or hallmark clinical programs.

- Joint ventures. When market entry or start-up costs pose challenges, joint ventures remain a viable pathway to growth. While the legal nuances are about as complex as a merger or acquisition, with careful evaluation, the benefits can outweigh the effort. One of the biggest advantages of a joint venture is that it creates shared obligation among the parties involved so that everyone is working toward its sustainability and success.

Some Final Thoughts

Due to the changes imposed by the ACA, healthcare is moving toward a new kind of hub-and-spoke model where the focus is for more care to be delivered in the outpatient setting where costs can be reduced, access can be increased and preventative and post-acute care can be administered in a more efficient manner.

While other health systems have successfully teamed up to expand their reach, such as Penn Medicine and Lancaster General Health; Johns Hopkins Children’s Center and WellSpan Health; and Holy Spirit and Geisinger Health System, these partnerships cover entirely separate markets, unlike the proposed merger between PinnacleHealth and Hershey. If there’s anything that can be learned from the failed merger, it’s that an emphasis needs to be placed on better defining geographic markets to avoid the perception of conflict in the future.

What are your thoughts on the failed Hershey-Pinnacle merger and how this will impact their growth strategy for the future? Join in the conversation by leaving a comment!