Already there are 33 states and the District of Columbia that have legalized marijuana use in some form. Many of these states, like Pennsylvania, allow for limited medical use. According to a recent article, dispensaries in Pennsylvania have sold more than seven hundred million dollars of medical marijuana since the Commonwealth implemented the program, just under two years ago. In that time, nearly 150,000 Pennsylvanians are now certified to buy weed.

While the debate of whether to legalize marijuana – medicinal or recreational – is heated, there is one aspect of this topic that is clear. The demand for the production and sale of medical marijuana is evident, both locally and nationwide. And for cannabis-friendly states, the demand for commercial real estate is on the rise. What does this mean for commercial real estate here in PA? Let’s take a look at a few key points.

Increased Demand for Both Commercial and Residential

States where medical and recreational marijuana are legal have seen increased property demand in both the commercial and residential sectors, according to a new study by the National Association of Realtors. The study also revealed that more than a third of real estate professionals polled said they saw an increase in requests for warehouses and other properties used for storage. In the same states, up to a quarter of members said they saw a spike in demand for storefronts, and one-fifth said there was a greater demand for land. States where marijuana has been legal the longest have seen the largest impact on both commercial and residential real estate.

A Double Edge Sword for Residential Real Estate

However, the residential sector has not benefited as much as the commercial sector; in fact there have actually been a few drawbacks as buyers assess the “new normal” of living near a grow house or dispensary. While between 7% and 12% of those polled said that they had seen increases in property values near dispensaries, between 8% and 27% said they’d seen property values fall. Homeowners are still adjusting to how they feel about purchasing property near areas of marijuana growth and consumption. In states where recreational marijuana is legal, 58 to 67 percent of residential property managers have seen addendums added to leases which restrict smoking on properties. The most common issue was the smell, followed by moisture issues.

CRE Investors See This as a Big Opportunity

Cannabis investors are buying up commercial property, particularly warehouses, in states where recreational and/or medicinal cannabis use has been legalized for more than three years, which was revealed in the same NAR study referenced above. Investors realize it is important to understand the supply and demand, and the regulatory dynamic in each state. Focusing on states with higher barriers to entry makes a license more valuable and makes that real estate more valuable. In 2018, warehouse demand in states with only medical use outpaced demand in states with recreational use, 34% to 27%, respectively, according to the NAR study.

The Economic Impact in Pennsylvania

Sales and participation have ramped up significantly since the program’s inaugural year. Last February, total sales had amounted to just $132 million, per the PA Department of Health. Fast forward twelve months, and the tally has risen to $711 million. That puts the Commonwealth at 439% sales jump from year one to year two. In a snap shot, Pennsylvania’s medical marijuana program has:

- 287,000 people registered

- 261,000 patients

- 1,800 registered doctors

- 1,300 approved doctors (practitioners)

- 168,000 active patients (2-2.5 visits a month)

- 4 million patient visits

- $711 million in total sales

- $288 million wholesale

- $423 million in retail sales

- $110 avg. purchase per visit

- 22 of 25 GPs are approved

- 15 of 25 GPs are shipping product

- 77 dispensaries are operational

Furthermore, dispensary operators don’t seem to think we’ve reached the saturation point yet. As more licenses are made available, and whatever lie ahead for further legalization of marijuana, one things is certain. As demand increases for marijuana, so will the demand increase for commercial estate.

What’s next for marijuana in Pennsylvania?

Back in October 2019, Governor Tom Wolf came out in favor of legalizing cannabis for recreational use. Last spring, a Franklin & Marshall College Poll showed that 59 percent, or nearly seven in 10 voters, support the idea of legalizing marijuana. But voter support alone is not enough. The legislation will have to pass both the House and the Senate, with much opposition particularly from the Republican Party.

While this doesn’t mean the possibility of someday legalizing recreational marijuana in Pennsylvania is off the table, it does mean there will be many hoops to jump through – just as there was for the legalization of medicinal use. Looking at the issue solely from an economic standpoint, there is much to be gained by continuing to open this market and remove barriers; however there are many other issues to consider.

Given the boost this has brought to commercial real estate, with the demand for more industrial and retail space, combined with more interest from CRE and cannabis investors, it’s wise to continue to watch for trends – both negative and positive. Looking to other states as examples also gives us insight into what to expect as the cannabis market in Pennsylvania grows, and how CRE professionals can continue to capitalize on the opportunity.

Do you agree with these trends and insights? Or do you have another viewpoint to share? Join in the conversation by leaving a comment below.

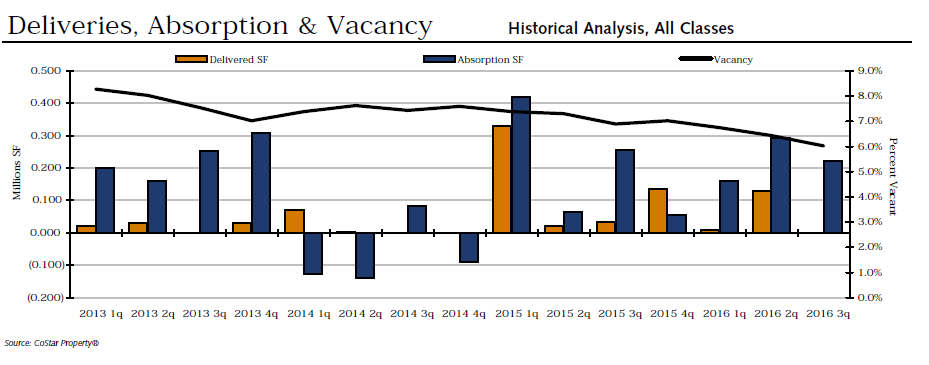

According to the PA Manufacturers Association, manufacturing and its affiliated businesses contribute $11 Billion to the economy in south-central Pennsylvania alone, providing our community with an estimated 110,000 jobs. This industry is a huge part of our local economy and its growth impacts the growth of many other businesses.

According to the PA Manufacturers Association, manufacturing and its affiliated businesses contribute $11 Billion to the economy in south-central Pennsylvania alone, providing our community with an estimated 110,000 jobs. This industry is a huge part of our local economy and its growth impacts the growth of many other businesses.