It’s the start of a new year and naturally this turns our attention toward what we predict will happen in the coming 12 months. Specifically in the commercial real estate market, there are several noteworthy trends and changes we predict to take place in 2017. What are these and how will they impact the various sectors of commercial real estate? Here’s the breakdown!

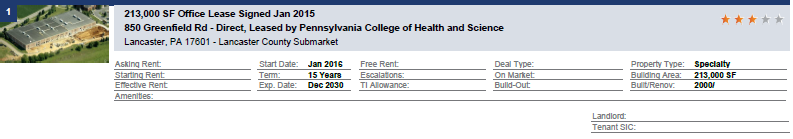

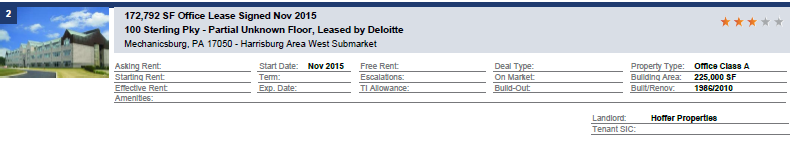

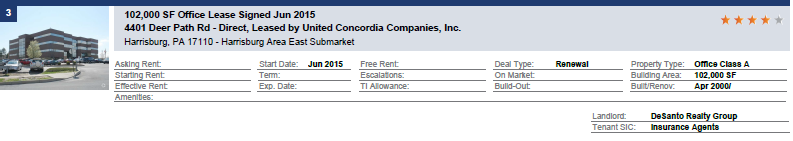

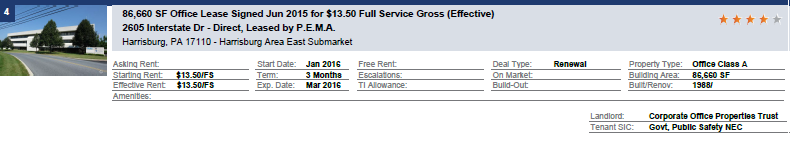

Office Real Estate

Experts are predicting that suburban markets will outperform downtown markets in 2017. Suburban rent growth is anticipated to exceed 2% while vacancies will only increase 10 base points (to 14.5%). In contrast, downtown vacancies are expected to increase by 30 base points (to 10.9%). The explanation to this growth is that suburban development is catering to millennials who want to live, work and socialize all in the same area. While national occupancy in downtown office space will still far exceed the suburban markets, suburban office space will have a much higher growth rate in 2017, relatively speaking.

Industrial Real Estate

Out of all of the sectors, industrial real estate will have the best year in 2017. Major growth in e-commerce as well as technological advancements, like driverless vehicles, have been fueling this sector’s growth. As these industries continue to thrive, so will industrial real estate! Availability sits at a 15-year low while net occupancy achieved its 26th quarter of record gains (as of Q3). Best of all, rents continue to climb toward a record-setting high. Because it wouldn’t be fair not to throw in a little bad news to keep things balanced, the sector is expected to slow down a bit as the result of a wane in user demand.

Retail Real Estate

2016 was not a good year for retail and it looks like 2017 will continue to get worse. Brick-and-mortar stores are closing and consolidating while e-commerce proves to be the way of the future. Online sales are expected to increase by 15.5% (to 9.2%) this year. On a brighter note, Class A malls are expected to maintain or increase their rents per square foot, as they have for the past five years. Also, experts predict that mixed-use lifestyle developments will be a possible solution for brick-and-mortar locations to compete with e-commerce. Finally, community strip centers are expected to grow by 1.7% in 2017.

Hotel Real Estate

In 2017 we expect to see a healthy labor market and wage growth which will ultimately benefit hotel real estate through an increase in leisure and business travel. However, major competitors to the hotel market, such as Airbnb and similar home-sharing businesses will continue to thrive. This is expected to steal sales from hotels as the concept of home-sharing becomes more mainstream and robust.

Multifamily Real Estate

Overall, experts are optimistic for the multifamily real estate market in 2017, but that’s not without a few key challenges. An increase in supply this year will drive up vacancy rates and impact rental rates as a result. Interestingly, it’s the high-end apartments that will experience the most shrinking rents, while Class B and Class C apartments will be less impacted. This is the first time since the Great Recession that supply outpaced demand, as it did in 2016. It’s expected to continue into 2017 which leaves some major hurdles to face moving forward.

What sector of commercial real estate do you think will be the most changed in 2017? Share your insights by leaving a comment!