According to a 2018 report from the Pennsylvania Data Center, Pennsylvania’s population is expected to grow approximately 1% from the 2010 to the 2020 population, which is 1% better than no growth or a loss. What’s even more remarkable, is Pennsylvania’s growth is focused in about 16 counties, 14 of which are in Pennsylvania’s South Central Region, South East Region and Lehigh Valley, including Pennsylvania’s fastest growing county population in our own Cumberland County, here in South Central PA.

Furthermore, estimated population growth in those 14 counties is about 3.8%, which is driving Pennsylvania’s overall modest population growth, while counties in Pennsylvania’s West and Northern Tier are losing population with only Butler and Centre Counties showing expected population growth.

All of this data raises a very important question…

How does Central Pennsylvania’s changing population stand to impact the economic development of our local businesses?

To help answer this, we asked David Black, President and CEO of the Harrisburg Regional Chamber and CREDC, to weigh in from his perspective and the changes he is seeing taking place in Central Pennsylvania. Here is what he shared.

***

Focusing on South Central Pennsylvania, which includes Adams, Cumberland, Dauphin, Franklin, Lancaster, Lebanon, Perry and York, it’s pretty good news for us. Population growth drives demands for products, services and community amenities – quality of life factors. The quality of life factors – everything from good restaurants, entertainment, quality public education, exceptional health care, transportation access and cost of living – are in part driven by more people paying more taxes and needing more services that feed into our positive economic cycle.

Focusing on South Central Pennsylvania, which includes Adams, Cumberland, Dauphin, Franklin, Lancaster, Lebanon, Perry and York, it’s pretty good news for us. Population growth drives demands for products, services and community amenities – quality of life factors. The quality of life factors – everything from good restaurants, entertainment, quality public education, exceptional health care, transportation access and cost of living – are in part driven by more people paying more taxes and needing more services that feed into our positive economic cycle.

Given our region’s transportation advantage via highways, rail and air and other amenities, South Central Pennsylvania is a great place to live, raise a family and have fun, plus we are close enough that if large metros like Washington, Baltimore, Philadelphia or New York is your thing, just a few hours will get you there. Quality of life issues help to attract and retain workforce, which is the business community’s number one issue these days, due largely to the fact that 10,000 baby boomers nationwide are retiring each and every day, leaving workforce challenges in many industries.

People want to live in vibrant communities. Some people prefer urban lifestyles, some are suburbanites while still others prefer the more natural rural lifestyles. Guess what? South Central Pennsylvania has it all. You can live on your 10 acres in Perry County and be to work in 30 minutes in downtown Harrisburg or walk to your job in center city Harrisburg from your apartment downtown, or your own home in Midtown, or commute 10 or 15 minutes from your suburban community to your job.

Population growth helps to drive business growth, it helps to drive additional growth in our region. While we think of ourselves as Harrisburg or Lancaster or York, commuting patterns show us that people commute from county to county to work because they can. I have a theory, with no disrespect to Lebanon County, that everyone in the Palmyra area actually works in Dauphin County at someplace with Hershey in the name! Businesses provide jobs, but people with the ability to spend drive local economies while our strategic location and transportation advantage help to connect us to the global economy and make South Central Pennsylvania such a special place to call home.

***

To offer additional insight, specifically on working age population growth in Pennsylvania, we asked Ben Atwood of CoStar, a national commercial real estate research firm.

***

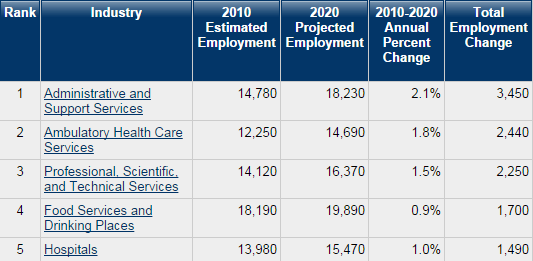

One of Costar’s recent articles entitled “Latest Census Data Shows Lehigh Valley Leading Pennsylvania in Working-Age Population Growth” stated that the latest data from the Census Bureau shows Pennsylvania continues struggling to lure in new industries and working age residents. The U.S. population aged 20-64 increased by 0.25% last year, but of Pennsylvania’s 67 counties, only seven surpassed this growth rate and 55 experienced net declines.

One of Costar’s recent articles entitled “Latest Census Data Shows Lehigh Valley Leading Pennsylvania in Working-Age Population Growth” stated that the latest data from the Census Bureau shows Pennsylvania continues struggling to lure in new industries and working age residents. The U.S. population aged 20-64 increased by 0.25% last year, but of Pennsylvania’s 67 counties, only seven surpassed this growth rate and 55 experienced net declines.

Harrisburg and its satellite markets are pretty underdeveloped (excepting Lancaster), relatively speaking. And the lack of modern office supply and relatively stagnant population growth means there likely won’t be major companies relocating into the area. Right now, that capital investment would have to be largely local, and how much are people locally willing to risk?

Central PA is in the position to grow in ways other areas in the state aren’t, but that doesn’t mean that growth will be rapid, or even guaranteed. The new developments will be riskier, hampering investor interest. This combined with stagnant, even waning growth in working age population can be cause for concern both near and long-term.

To some extent, the optimism about population growth is misplaced because it could just mean these areas will have a slightly easier go of it over the next few decades, as automation continues to eat away at blue collar jobs in retail, shipping, and professional services in the Commonwealth’s smaller markets.

Things change and evolve, and no one can predict the future, but a lot of growth in these areas is in transportation and manufacturing, industries with long term automation risks, and there’s plenty of reasons to believe automation will expand into white collar employment in the near future.

***

Omni Realty Group is very grateful for David and Ben’s expertise and input. It’s fascinating, yet not surprising that population growth can have such a profound impact on quite literally everything else. Here in Central Pennsylvania we have a valuable opportunity to harness this growth and use it to fuel our economy. This further emphasizes the point that there are many unique benefits to live, work, and play in this region. Whether you call Central Pennsylvania home, are employed in the region, or simply enjoy visiting to experience its social offerings, you are playing an important role in the growth of our economy.

How else do you feel that our region’s changing population stands to impact local businesses? Join in the conversation by leaving a comment below.