Vacancy rates in the local office market remained mostly stagnant moving into the New Year.

If the saying “no news is good news” can be applied to Central Pennsylvania’s office real estate market, then 2017 was a good year indeed! We closed out 2017 with few noticeable gains and mostly stagnant vacancy and rental rates. On a positive note this means there were no lasting drops to cause volatility to the market; however, if “stagnant” remains an ongoing theme for our local office real estate market in 2018, we may have some cause for concern.

Let’s take a look at some key data for our three local submarket clusters: Harrisburg/Carlisle, Lancaster and York/Hanover. You will see that each experienced its own ebb and flow with some submarket clusters faring better than others at the close of fourth quarter 2017. The most important question to consider when looking at this data is: “What submarket is poised to perform the best in 2018 and what does that mean for commercial real estate and our local economy?”

Harrisburg/Carlisle Submarket Cluster

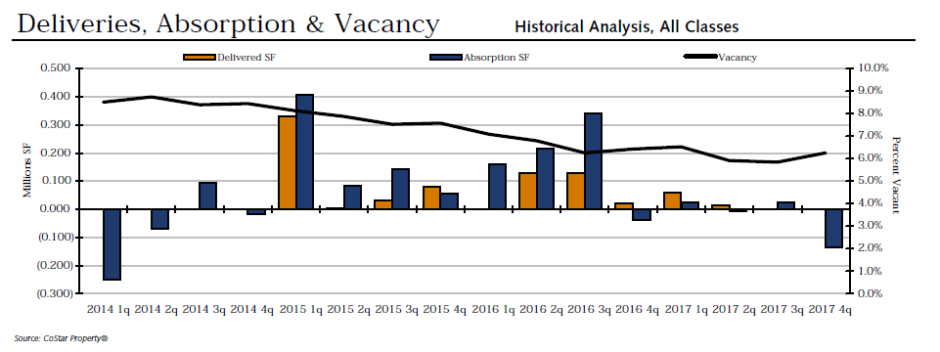

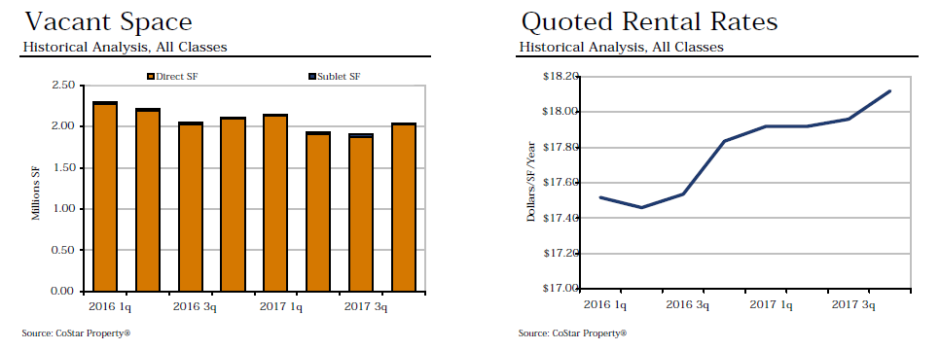

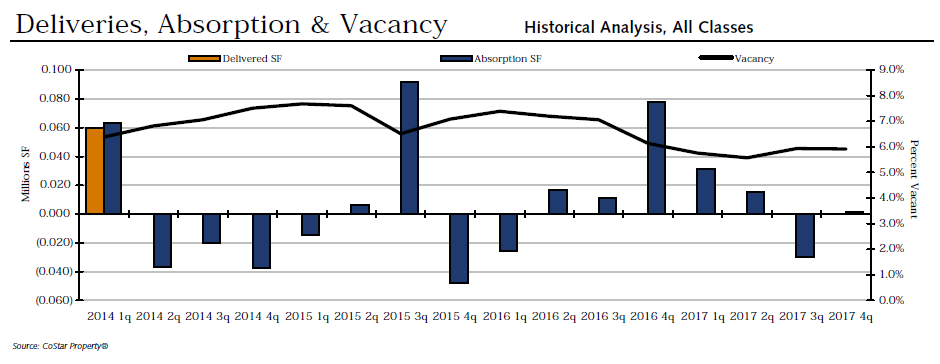

Vacancy – The office vacancy rate for the Harrisburg/Carlisle Submarket Cluster increased to 6.3% at the end of the fourth quarter 2017. The vacancy rate was 5.8% at the end of the third quarter 2017, 5.9% at the end of the second quarter 2017, and 6.5% at the end of the first quarter 2017, placing it just shy of where we began the year.

Absorption – Net absorption for the Harrisburg/Carlisle Submarket Cluster was a negative (135,877) square feet in the fourth quarter 2017. That compares to positive 25,603 square feet in the third quarter 2017, negative (6,036) square feet in the second quarter 2017, and positive 22,829 square feet in the first quarter 2017.

Largest Lease Signing – The largest lease signing occurring in 2017 was the 57,764 square foot lease signed by Pennsylvania Health and Wellness, Inc. at 300 Corporate Center Drive located in Camp Hill.

Rental Rates – The average quoted asking rental rate for available office space, all classes, was $18.12 per square foot per year at the end of the fourth quarter 2017 in the Harrisburg/Carlisle Submarket Cluster. This represented a .89% increase in quoted rates from the end of the third quarter 2017, when rents were reported at $17.96 per square foot.

Inventory – Throughout 2017, a total of two new office buildings were delivered to the market with a combined total of 73,000 square feet. At the close of the fourth quarter, two additional buildings remained under construction with a combined total of 70,000 square feet of inventory yet to be delivered.

Lancaster Submarket Cluster

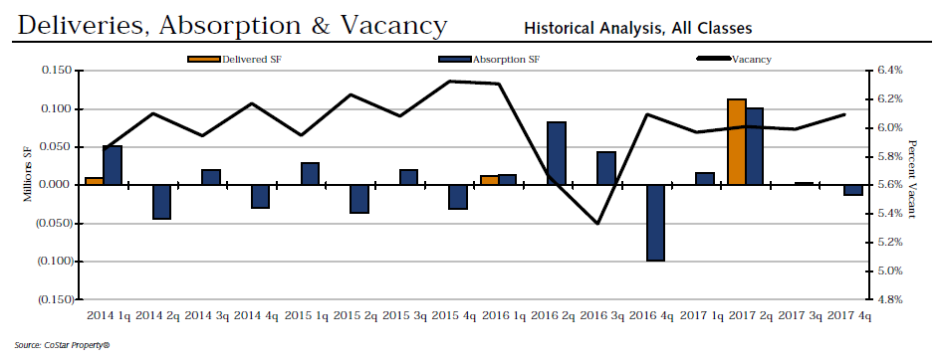

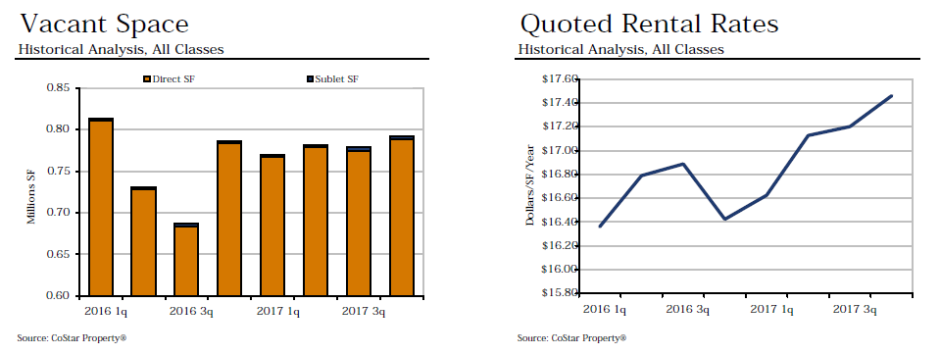

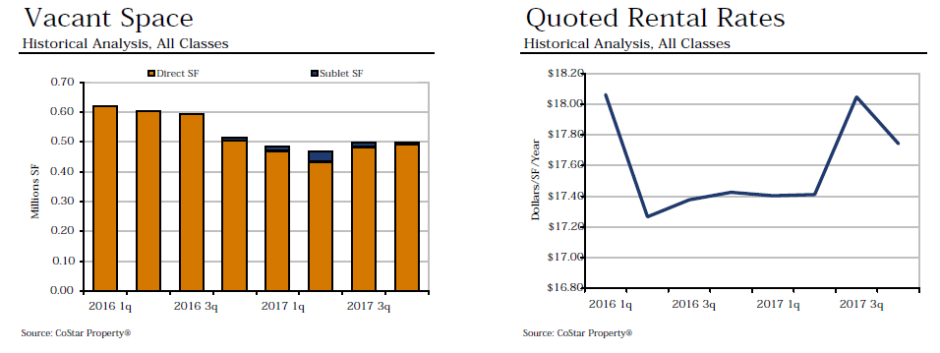

Vacancy – The vacancy rates for the Lancaster Submarket Cluster in 2017 held steady for the first three quarters at 6.0%. Only in fourth quarter 2017 did we see the slightest movement in vacancy to 6.1%. Since its dip to 5.3% in third quarter 2016, the vacancy rate has returned to its recent historical average where it continues to remain stable.

Absorption – In the fourth quarter of 2017, net absorption dropped into the negatives for the first time all year, ending 2017 at negative (13,391) square feet. Net absorption was 2,462 square feet in third quarter 2017, 101,013 square feet in second quarter 2017 and 16,187 square feet in first quarter 2017.

Rental Rates – Even with a drop in net absorption and only a slight increase in vacancy rates, the quoted asking rental rate for available office space, all classes, in the Lancaster Submarket Cluster continued to increase throughout 2017. In the first quarter the quoted rental rate was $16.63, $17.13 in the second quarter, $17.20 in the third quarter and $17.46 in the fourth quarter. This is the highest quoted rental the Lancaster Submarket Cluster has experienced since prior to 2014.

Inventory – Two new office buildings were delivered to the Lancaster Submarket Cluster in 2017. Both delivered in the second quarter and combined they added a total of 113,000 square feet of new office space.

York/Hanover Submarket Cluster

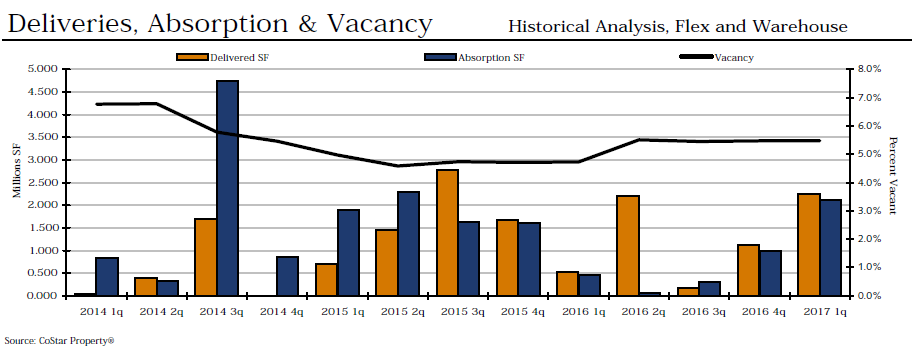

Vacancy – The fourth quarter office vacancy rate for the York/Hanover Submarket Cluster held steady at 5.9%, the same as it was in the third quarter. This is slightly higher than the 5.6% vacancy rate in the second quarter and the 5.8% vacancy rate in the first quarter.

Absorption – The fourth quarter ended with a net absorption of 1,400 square feet. This is an increase from the third quarter’s negative (29,853) square feet that was a significant drop from the second quarter’s 15,646 square feet the first quarter 2017’s 31,636 square feet. This is the only increase in net absorption the market experienced in 2017.

Rental Rates – 2017 started off with a fairly steady quoted asking rental rate for available office space, all classes, of $17.40 per square foot. It increased by $0.01 in the second quarter to $17.41 and spiked in the third quarter at $18.05. Though still higher than the first two quarters, 2017 finished with a slight dip in quoted rental rates as it fell to $17.74.

Inventory – No new office buildings were delivered in the York/Hanover Submarket Cluster in 2017. There is one building under construction with a total RBA of 840 square feet.

Looking at the comparison of the three Central Pennsylvania submarket clusters, which do you feel is in the best position to start making some moves in 2018? Share your ideas by leaving a comment below.