The Central Pennsylvania industrial real estate market is an active place to be right now! In second quarter 2016, three new properties were delivered with three more under construction. Most interestingly, none of this new space is preleased. Both vacancy and rental rates continue to rise to some of the highest numbers we have seen in recent quarters.

What do these trends tell us about the health of the industrial market and the local economy? Let’s take a closer look at the highlights from second quarter 2016.

Select Year-to-Date Deliveries:

The Lebanon Valley Distribution Center, located at 139 Fredericksburg Road, Fredericksburg was delivered this quarter with an RBA of 874,126 square-feet that is not preleased. Another Central Pennsylvania building delivered in second quarter 2016 is the property at 192 Kost Road, Carlisle. It has an RBA of 422,200 square-feet and is not preleased. Third, LogistiCenter 78-81 delivered another 405,000 square-feet of unleased space this quarter. Combined, this is 1,701,326 square feet of new, unleased industrial space delivered in second quarter 2016.

Top Under-Construction Properties:

In addition to the buildings delivered to the market this quarter, there are three more under-construction properties in Central Pennsylvania that will be delivered in the coming year. The Eden Road Logistics Center will be delivered in fourth quarter 2016. It has an RBA of 754,881 square-feet and is 0% preleased. Trade Center 44 is also expected to deliver in fourth quarter 2016. This property has an RBA of 620,000 square-feet and is 0% preleased. Finally, Crossroads Logistic Center is expected to deliver in first quarter 2017 with an RBA of 398,250 square-feet. It is also 0% preleased.

Select Top Sales:

Three of the nine Select Top Sales between April 2015 and June 2016 took place in Central Pennsylvania. Coming in at number one on the list is Park 81 in Shippensburg. This 1,495,720 square-foot facility sold for $83,000,000 to CBRE Global Investors, LTD. Number five on the list is 100 Louis Parkway in Carlisle. This 400,596 square-foot facility sold for $28,850,000 to Industrial Property Trust. The final Central Pennsylvania property on the list, ranking number seven, is located at 1225 S. Market Street, Mechanicsburg. With 596,703 square-feet, this property sold for $21,350,000 to Allen Distribution.

Absorption and Demand:

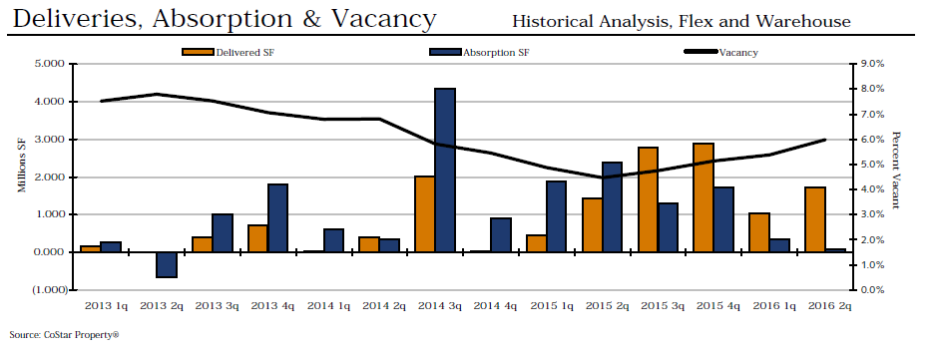

Net absorption once again dropped this quarter to 69,303 square-feet. If this trend does not soon reverse, we are inching our way closer to a negative net absorption that we have not seen since second quarter 2013. Net absorption has been declining each quarter since reaching a peak of 2,382,561 square-feet in second quarter 2015. Though this quarter was not the drastic decrease we have seen in most recent quarters, it is still contributing to the downward trend.

Vacancy:

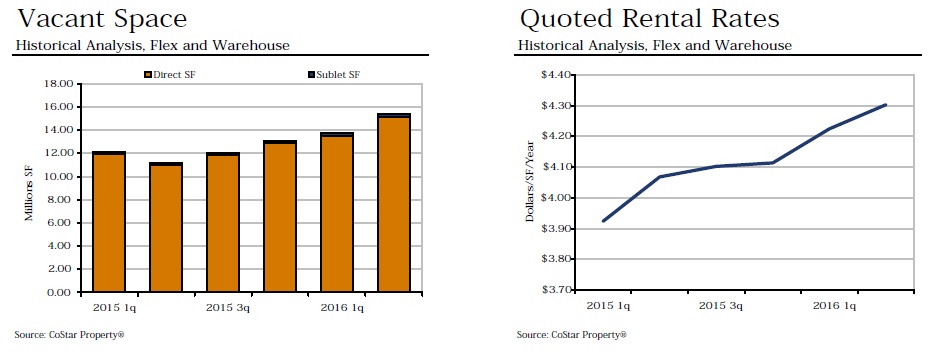

Vacancy has increased this quarter, rising to 6.0%. This is the highest vacancy rate we have seen since second quarter 2014. After reaching a low of 4.5% in second quarter 2015, vacancy has continued to rise steadily.

Rental Rate:

The quoted rental rate is also on the rise. Second quarter 2016 ended with a rate of $4.30 per square foot. This is the highest rate we have seen since prior to third quarter 2012. It was only midway through 2015 when we saw this rate exceed $4.00 and it has been steadily rising ever since.

Our Summary/Analysis:

With so much new, unleased space entering the Central Pennsylvania industrial real estate market right now, it’s obvious why net absorption continues to decrease. By first quarter 2017, another three new, unleased buildings will be completed which leads us to predict that a negative net absorption in in our not too distant future. Following this trend, vacancy rates will continue to rise as well.

Where it gets interesting is even with all of this new, unleased space and vacancy rates on the rise, second quarter 2016 experienced the highest quoted rental rate we have seen in recent years. What this tell us is that the demand for industrial space in Central Pennsylvania continues to outpace supply.

In a recent Central Penn Business Journal article, many experts weigh in on the thriving industrial market. The consensus? We will continue to see growth, especially with retailers’ increased emphasis on faster home deliveries. To accomplish one-day deliveries, for example, this calls for more facilities in closer proximity. The demand may not necessarily be for larger warehouses, but for more warehouses placed in prime locations. And Central Pennsylvania is a prime location for warehousing and distribution, indeed!

What additional impact do you think all of this new industrial space will have on the Central Pennsylvania market? Share your insight by commenting below!