As a tenant needing commercial real estate space to run your business, it can be challenging to navigate the many twists and turns of finding the right space and entering into a favorable lease agreement. Your lease with your landlord can have a large impact on the success of your business, or it could cause many headaches. To ensure you’re entering into a fair and favorable agreement, let’s look at some of the most common red flags that can pop up in a commercial real estate lease.

As a tenant needing commercial real estate space to run your business, it can be challenging to navigate the many twists and turns of finding the right space and entering into a favorable lease agreement. Your lease with your landlord can have a large impact on the success of your business, or it could cause many headaches. To ensure you’re entering into a fair and favorable agreement, let’s look at some of the most common red flags that can pop up in a commercial real estate lease.

Term of Lease – One of the most important pieces in a commercial real estate lease, short of the price, is the duration of the lease and how it’s structured. You want to be sure you fully understand when your lease begins and when it ends, especially when the landlord is making improvements to the space. A landlord may provide more favorable pricing or terms when entering into a lease that has a longer duration. While this is helpful from a budget perspective, be sure you feel confident that you will want to stay in this space for that amount of time.

Lease Renewal – Another possible red flag in a commercial real estate lease is when and how the lease will renew. When your current lease comes to an end, a landlord may desire the lease to auto-renew. As a tenant, you will want to be aware of this well in advance so that if you do not want to renew your lease you have options to exit the lease. Additionally, look to see if the lease specifies a change in price upon renewal. Sometimes there will be an increase that could hit you unexpectedly.

Lease Termination – Next, be sure you know the terms and penalties for breaking a lease. While it may not be your intentions to break the lease early, various factors impacting your need for the space could make it necessary. If the Lease imposes a steep monetary penalty for breaking the lease early, you may wish to negotiate that down to more favorable (and reasonable) terms.

Environmental Considerations – Some commercial real estate leases may specify that a tenant may not store any hazardous materials on the premises. This is not typically an issue; however, you will want to be sure that included in the lease is a warranty from the landlord that the premises are free of such hazardous materials. In a situation where you plan to use the commercial space (such as a warehouse) for storage of consumables (i.e., food and drinks), you may want assurance that your inventory is not likely to be contaminated.

Insurance – Be sure to check the required minimum coverages for a tenant’s liability insurance. Typical coverage minimums are $1 million per occurrence and $3 million in the aggregate. If the lease specifies higher minimums at a price that is concerning, you will want to make this part of your negotiations before signing the lease.

Maintenance – A commercial real estate lease should outline who is responsible for the repairs and maintenance of all building systems, including HVAC, electrical and plumbing. Should the lease place the responsibility on the tenant, you may wish to renegotiate this. In a situation where the tenant is only leasing a small percentage of the overall building space, it’s unusual for the tenant to assume the costs of repair and maintenance for things that impact more than their rented space.

Defaulting – Closely review the language in the lease regarding missed or delayed rent payments. It is reasonable to request at least one written notice during any 12-month period (to account for a reasonable mistake), as well as a 5-day grace period for rent payments.

Relocation – Some commercial real estate leases may include a section about relocation. Does this grant the landlord the right to relocate the tenant? Under what terms? Pay attention to this piece as it could greatly inconvenience you, if it ever takes place.

While this is by no means an exhaustive list of red flags of which you must be aware when entering a commercial real estate lease, this should provide a great starting point. What’s most important is to review every document closely, ask for clarification, and seek professional tenant representation early in the process. Having an exclusive tenant representative on your side will provide an added layer of knowledge, experience, and protection that will put you in the best position to negotiate a fair and favorable lease.

Do you have a question related to your commercial real estate lease? Reach out to Omni Realty today so we can help you find an answer!

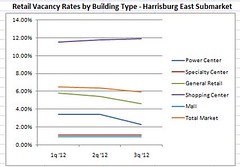

The Harrisburg East retail market experienced a lower vacancy rate during the third quarter of 2012.The rate ended at 5.9% compared to the previous quarter when vacancy was 6.4%. The third quarter represented the first time in 2012 where the retail vacancy rate was below 6%.

The Harrisburg East retail market experienced a lower vacancy rate during the third quarter of 2012.The rate ended at 5.9% compared to the previous quarter when vacancy was 6.4%. The third quarter represented the first time in 2012 where the retail vacancy rate was below 6%.

As we continue to develop our social media communications, we also have the opportunity to learn from others. We’ve followed conversations across platforms to devise a list of some of the folks we keep our eye on. Here’s our list of the top five Commercial Real Estate (CRE) professionals in social media and why we love to follow them!

As we continue to develop our social media communications, we also have the opportunity to learn from others. We’ve followed conversations across platforms to devise a list of some of the folks we keep our eye on. Here’s our list of the top five Commercial Real Estate (CRE) professionals in social media and why we love to follow them!