When a global pandemic first hit, the main concern was rightfully on the health and wellbeing of our population. As we slowly gained knowledge and tools to bring the spread of this virus under control, something equally as powerful and disruptive was already burning through the economy like wildfire.

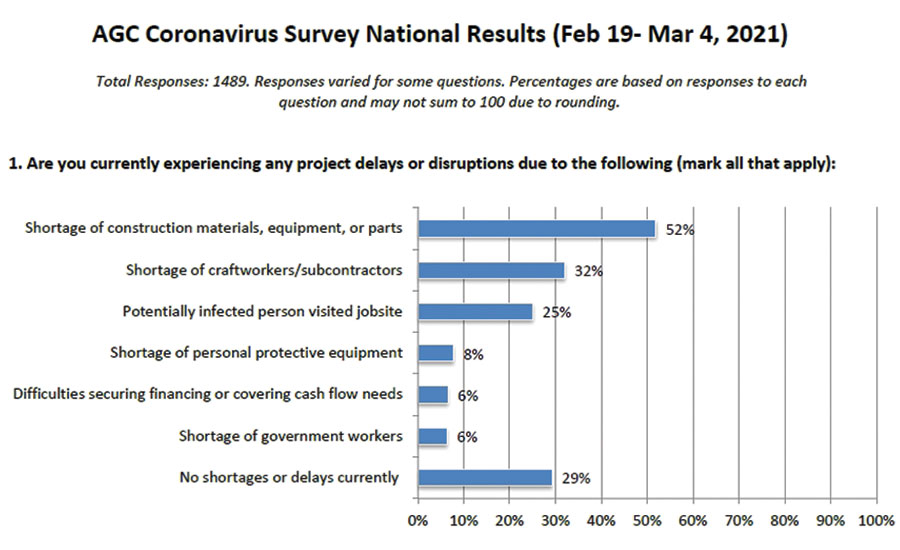

Ongoing pandemic-related disruptions in the supply chain of a range of construction materials are undermining project demand and this has trickled down to impact just about every industry imaginable. Most directly, the delays and cost increases fall on construction businesses, their workers, and their clients who are waiting on them to complete projects varying from a single-family home to mega complexes that have been in the works for years.

These mass shortages caused by the inability to ship or receive some of our economy’s most essential materials, such as lumber and steel, have the construction industry in between a rock and a hard place. And we can be sure that they will not be the only sector to feel the blow of delayed project timelines and skyrocketing costs. How does all of this stand to impact the progress and financial health of our economy? Keep reading for key insights.

Understanding the Impact

According to construction project estimators, one of the biggest reasons for material shortages is the inability to ship available materials by rail or truck. Due to container and trucking shortages being felt across the country, anything with significant shipping and logistics components is highly likely to cause lead time issues. If the easing of tariffs is put into place, pricing and availability should begin to return to normal levels, which would have a positive impact on current projects and the market as a whole. However, with the shipping container and freight backlog that currently exists, bringing in significant quantities of overseas material only adds to the current challenge.

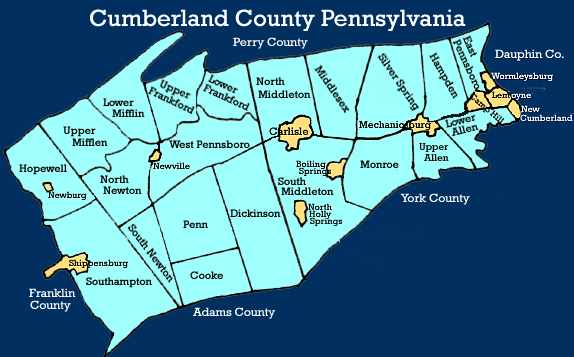

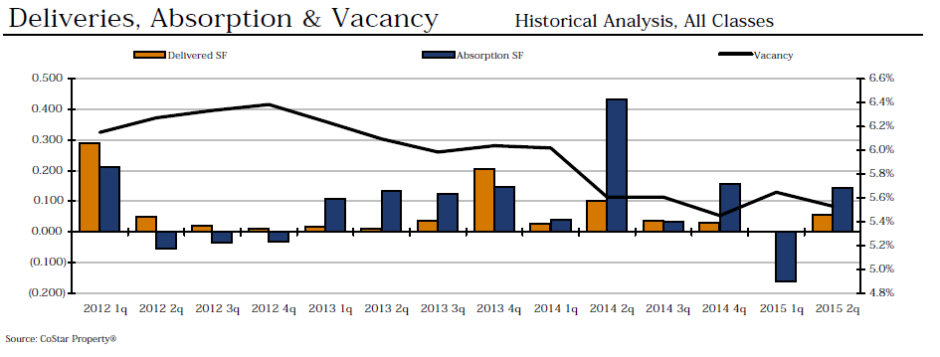

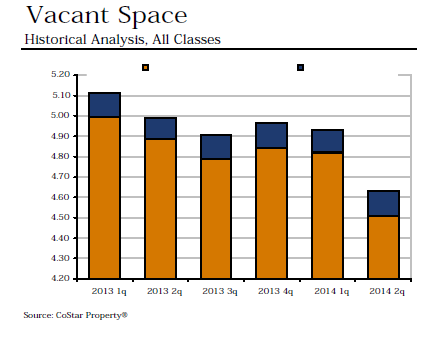

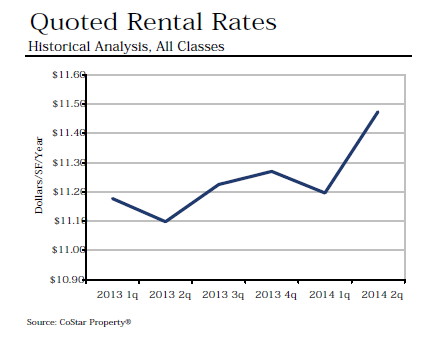

GRAPH COURTESY OF AGC OF AMERICA

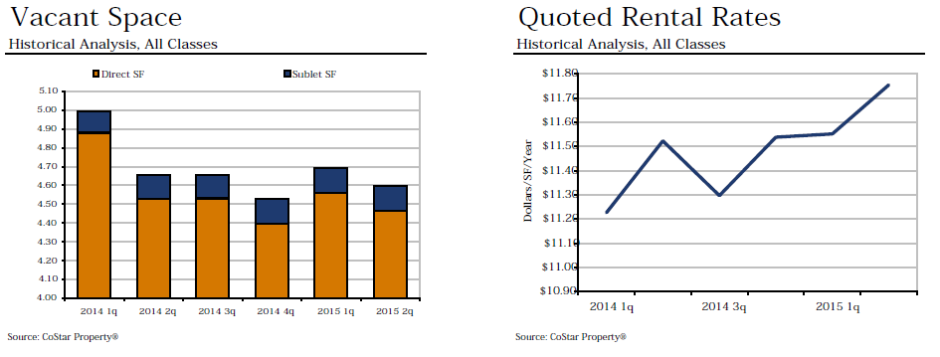

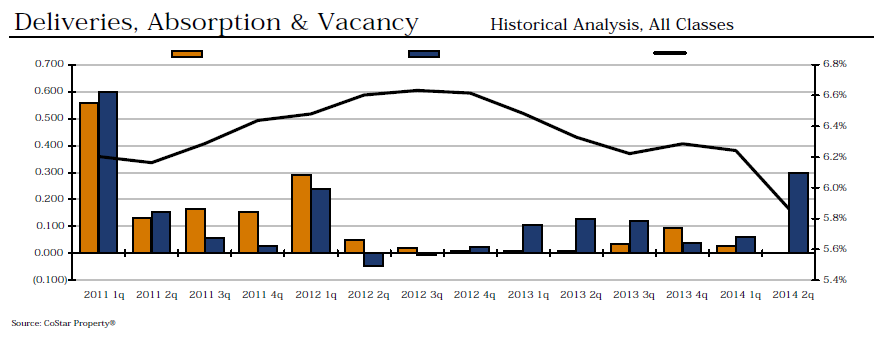

GRAPH COURTESY OF AGC OF AMERICA

Shortages Drive Cost

While general contractors can usually protect against the expectation that costs will increase, the construction industry has not experienced such dramatic material cost increases in recent history. Material cost increases, coupled with the already existing labor and housing shortages, will continue to impact the industry, domestically and globally, for the foreseeable future. Such shortages could delay the start of new projects around the country and may trigger additional claims on projects that are currently underway.

These increases and challenges are cause for concern; it’s important for business owners to consider the types of materials that their project will require. While commercial construction material costs have risen as well, it is not to the extent that residential construction costs rose due to its heavy reliance on softwood lumber. For commercial construction, steel prices generally have a greater impact.

Delays Across the Board

Some material suppliers have completely canceled their bids or contracts due to the lack of materials. While others have indicated delays of six months or more and are currently quoting prices for materials (like engineered wood products) that will not ship until early 2022! Because of these setbacks, the industry can expect an increase in claims and disputes over material prices and associated delays.

Getting Creative with Contracts

Project participants might consider amending their contracts, incorporating new or modified cost-escalation provisions, or adding riders for adjustments to contract terms based on certain material cost increases, such as based on express percentage increases. Parties might also negotiate contract allowances for certain materials or incorporate cost-sharing for material price increases that exceed certain thresholds.

Push On or Wait?

Borrowing is very inexpensive right now, and even a slight increase in lending rates down the road could add hundreds of thousands of dollars in overall costs, depending on the length of the loan agreement. Project owners need to weigh the risks of waiting for material prices to come down against the probability of rising inflation and interest rates. Likewise, if waiting means you can’t expand your production capacity, grow your business, or address the needs of those you serve because of your facility’s limitations, the long-term implications could negate and even overshadow any potential savings.

What’s most important to keep in mind is that the market has demonstrated again and again that everything flows. Trends (and troubles) will come and go, and when the market experiences a negative impact caused by something else, it will look to correct itself almost immediately. To address the delay of construction materials and labor, and the rise in construction costs, as a result, we can see solutions already emerging. These range from using alternate materials, negotiating more flexible terms within a contract, phasing out projects, and getting creative with how and when to borrow money to take advantage of low-interest rates.

The commercial construction industry will rebound, if not even stronger than it was before the pandemic hit. The lesson here is to remain patient, seek innovative and collaborative solutions, and keep your eyes set on the long-term evening-out of any negative impact you may be experiencing today.